The covid pandemic clearly highlighted those companies that truly care about their customers and which provide customer service excellence.

If a company claims to be customer centric, they must not just talk the talk, but walk the talk too. The pandemic gave many people more time to review from whom they bought and what services they were getting in return.

A few years ago I was prompted to question my own purchase decision of cable services from the Swiss company UPC-Cablecom. It had been known to have a long-term deficit in customer service excellence versus its main competitor Swisscom. And as recent PWC research shows, 86% of buyers are willing to pay more for a great customer experience.

Swisscom has made customer service their MSP (main selling point or value proposition) and they were renowned for putting their customers first. UPC-Cablecom, on the other hand, had until then, been trying to win customers through non-stop promotions and aggressive price cutting. In today’s connected world, especially where the internet is concerned, dissatisfied customers will be quickly heard – across the net.

Back to the incident that prompted this post. After a few days of being ignored by UPC-Cablecom – my perception at least, because my emails and phone calls were not being answered – I’m somewhat embarrassed to say that I resorted to Twitter.

More than five years ago, Twitter was first referred to as today’s customer service centre. Social media usually guarantees a quick response, since contacting customer services through the usual channels often results in no reaction for hours if not days.

What makes a great customer care centre?

Customers these days expect a response in minutes or hours rather than days. Research shows that nearly half of all customers (46%) expect companies to respond faster than 4 hours, and 12% expect a response within 15 minutes or less. And yet the average time to respond to customer service requests is currently 12 hours and 10 minutes! How do your own customer service response times compare? As you enjoy my blog posts I assume they are significantly better.

Most call centres are a frustrating, if sometimes necessary, experience for (often dissatisfied) customers to endure. In many cases, they are automated, with a long and complex self-selection process of button pushing to arrive at the department one needs – if you’re lucky that is!

But too often the result of all that effort is just a recording telling you to call back later as the department needed is not open at the moment, or that the collaborators are currently busy and to please stay on the line.

We are next subjected to music supposedly designed to calm our nerves, interspersed with messages suggesting alternative solutions to waiting in line. Go to the website to find a solution in their available FAQs, complete a contact form, or send an email. I find this insulting since I am sure most people only call after trying to find a solution … Click to continue reading

Juvena of Switzerland: The short message to “Enjoy the smoothness” on the back of the Juvena hand cream sample tube, makes the experience both …

Juvena of Switzerland: The short message to “Enjoy the smoothness” on the back of the Juvena hand cream sample tube, makes the experience both …

Let’s start at the very beginning – with the customer of course!

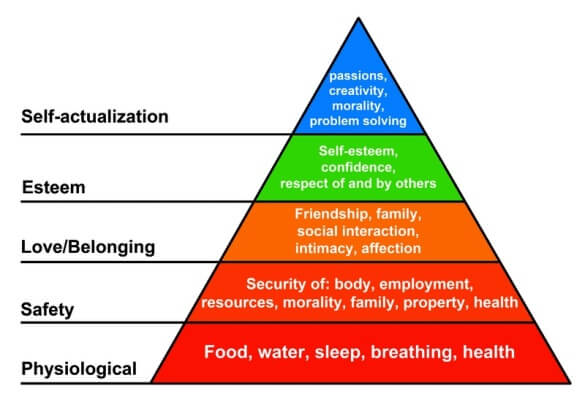

Let’s start at the very beginning – with the customer of course! They certainly have several needs, but you should aim to address only one of them.

They certainly have several needs, but you should aim to address only one of them.

Do you know what needs your customer has and which of them you are tapping into?

Do you know what needs your customer has and which of them you are tapping into?