I think it’s pretty clear to everyone in business that NOT knowing your target customer costs a lot – sometimes the business itself! (Think Kodak, Nokia, Borders)

So let me ask you this; how well do you really know your own target customers? Are they men, women, younger, older, Fortune 100 companies, local businesses? If you can at least answer that, then you have the basics, but how much more should you know about them?

Well I can help you there, with these 12 essential elements of a customer persona or avatar.

Background

I was recently working with a local service provider that was looking to improve their online presence. They were keen to have more impact on social media and had asked for advice about the best platforms, optimal frequency of publishing and possible content ideas.

They are a new client for me, so I think they were a little surprised when I didn’t get straight into the “sexy” topic of social media. Instead, I started by taking them through the basics of target customer identification. Lucky for them that I did!

When we had finished the exercise, we had actually found five different targets for them to address, rather than just the two they had been addressing until now. This clearly would have an impact on both where, what and how they communicated online.

It is for this reason that I always recommend that every brand and business completes a target persona and regularly updates it every time they learn something new about their customers. I also encourage you to keep it handy, ideally always visible on or around your desk. That way you will always be thinking customer first whenever you are working on a new project.

So let’s imagine that we’re having our first meeting together and I’m asking a few (well 12 actually!) questions about your customers. How many can you immediately answer?

The 12 Essential Elements of a Target Customer Persona

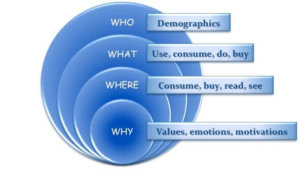

C3Centricity has designed a simple template that helps clients have all the essential information about their customers in one place, summarised on one page. It’s called the 4W™ Persona Template; if you haven’t already done so, you can download it, together with a detailed workbook explaining exactly how to complete it. Just click on the image below.

I would highly recommend you download it right now, before continuing to read, so that you can follow along with the one-pager in front of you.

Here are the 12 essential elements you need to have at hand in order to complete the template:

1. WHO – DEMOGRAPHICS: This is usually a “no-brainer” and is how most organisations describe their customers. However it’s not really original and definitely not competitive, although they are an essential foundation.

But there is so much more you should and absolutely must know about your customers, so read on.

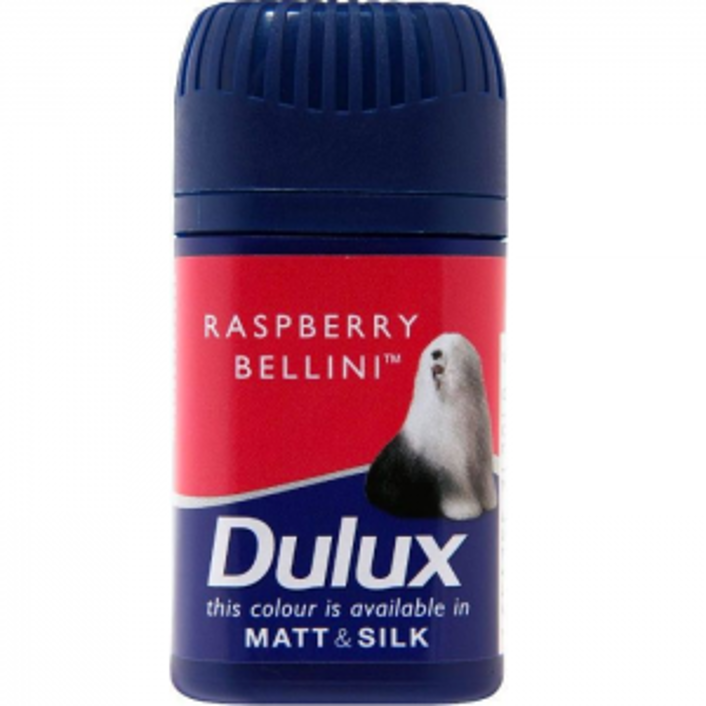

2. WHAT THEY USE: Whether you are offering a product or providing a service, you … Click to continue reading

In most organisations today, using competitive products is still frowned upon; after all, we make the best don’t we, so why use those of other companies?

In most organisations today, using competitive products is still frowned upon; after all, we make the best don’t we, so why use those of other companies? In one of my previous positions, the company had an incredible competitive library. This included every single competitive product that was available from all around the world, classified by country and organised by segment.

In one of my previous positions, the company had an incredible competitive library. This included every single competitive product that was available from all around the world, classified by country and organised by segment.

OK I’m starting off slowly, but do you know who your customers are? Not who uses your category, but who the people are that actually buy your product or service today? How much do you really know about them?

OK I’m starting off slowly, but do you know who your customers are? Not who uses your category, but who the people are that actually buy your product or service today? How much do you really know about them?