Do you consider your packaging to be a part of the product, protecting its contents and framing its on-shelf life? Or do you consider it to be an integral part of your connection with your customers at an important moment of truth, that of purchase and usage? Or both of these?

If you answered both, then I believe that you are making maximum use of your packaging or at least you recognise its potential for communicating.

If you answered only one of the choices, then you may be missing an important opportunity. Let me explain, with a few examples.

People don’t read instructions

We all expect most things that we use or consume to be intuitive these days. In other words, we assume that we will understand how to build / cook / use them without reading the manual / instructions.

If you are like most people – myself included – this has nothing to do with the complexity of the product concerned. I myself will only turn to the instructions when something doesn’t work: I end up with left-over screws when mounting a flat-pack piece of furniture, or I can’t achieve multi-recordings on my smart TV or cable box.

In the article How Likely Are You to Read the Instructions they link behaviour to personality types. It makes an interesting read and offers at least some explanations as to why many (most?) of us still don’t read instructions.

Since the internet arrived, we have access to more and more information, and yet we seem to be reading less and less. Therefore as marketers, we need to ensure that any vital information we want to share, is clearly highlighted on the pack.

People do look at packs

Whether it is the cream we put on our faces, the cereal we eat for breakfast, or the dip that we offer to friends on match night, there are moments when we are faced with packaging for more than a split second. It is at these times that we are likely to read at least some of what is written on the pack.

It therefore makes sense to provide more than just a list of ingredients. After all you have your customer’s attention, so make use of it to impress or educate.

Here are a few of the best examples I have come across:

Nestlé does a great job of providing useful information on their pack,s with their “nutritional compass.” This includes four different pieces of information: good to know, good to remember, good question and the nutritional data.

What I particularly like about what Nestle has done, is to combine mandatory information on nutritional values, with useful information for the consumer. Although they may not be the most consumer centric company around, at least they did think consumer first in the development of their “compass.”

Juvena of Switzerland: The short message to “Enjoy the smoothness” on the back of the Juvena hand cream sample tube, makes the experience both … Click to continue reading

Juvena of Switzerland: The short message to “Enjoy the smoothness” on the back of the Juvena hand cream sample tube, makes the experience both … Click to continue reading

In most organisations today, using competitive products is still frowned upon; after all, we make the best don’t we, so why use those of other companies?

In most organisations today, using competitive products is still frowned upon; after all, we make the best don’t we, so why use those of other companies? In one of my previous positions, the company had an incredible competitive library. This included every single competitive product that was available from all around the world, classified by country and organised by segment.

In one of my previous positions, the company had an incredible competitive library. This included every single competitive product that was available from all around the world, classified by country and organised by segment.

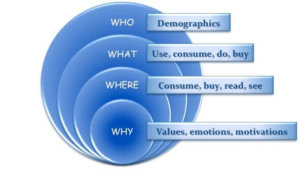

OK I’m starting off slowly, but do you know who your customers are? Not who uses your category, but who the people are that actually buy your product or service today? How much do you really know about them?

OK I’m starting off slowly, but do you know who your customers are? Not who uses your category, but who the people are that actually buy your product or service today? How much do you really know about them?