It is a well-known fact that when budgets are tight, marketing is usually one of the first departments to suffer cuts, and market research in particular!

Why is this? I believe it is because their ROI is longer-term and often difficult to prove. They therefore make the perfect target for sweeping reductions. What they all need is a strategic growth blueprint.

A few years ago, I was asked to talk on this topic at the Planung&Analyse conference in Frankfurt. Despite rave reviews of the talk itself, many commented that they would have liked me to propose some sort of formula to help them to better defend themselves. So I decided to do just that with this post, but first a warning; customer understanding is being lost!

According to research by BurtchWorks, 20.7% of researchers changed jobs after an average of 3.1 years in their position. However, those with over ten years experience showed slightly lower levels of churn (17.8% and 3.4 years)

A study from Spencer Stuart among CMOs of Fortune 500 companies found that the average tenure is 4.2 years, roughly on par with the rest of the C-suite (4.4 years), with B2B companies (4.4 years) slightly better off than B2C (4.1 years).

These numbers made me realise that customer understanding risks being forgotten and then constantly reinvented by newly hired people in marketing and market research positions. What a waste of resources!

But there is something that you can do to increase the ROI of your spending, which is something the C-suite has long demanded of marketing departments.

And that is to develop a CMO Strategic Growth Blueprint that includes reimagining market research and how data and information are used.

Here’s how.

If you prefer to listen rather than read:

The ROI of Market Research

The challenge of proving the value of market research (MR) has also been a hot topic for more than a decade. And yet we didn’t seem to be any closer to solving it, at least until recently. I think that this is because all the studies I have seen on the topic concentrate on identifying what is wrong, but rarely offer help in what to change to provide more visible value to their companies. I want to put this right.

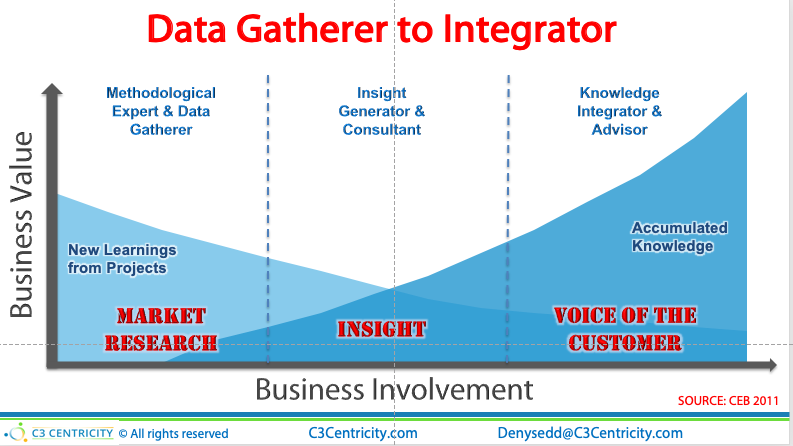

The CEB / Gartner Analysis: This analysis concludes that MR provides two types of value. Firstly from new projects and secondly from accumulated knowledge over time. By plotting these two, they came out with a three-phase progression of how MR can add value to an organisation. (see below)

However, with both marketers and market researchers changing jobs (too) frequently, there is far less accumulated knowledge than previously. But don’t worry I have the solution in the form of a new model of CX, which I will explain in a moment.

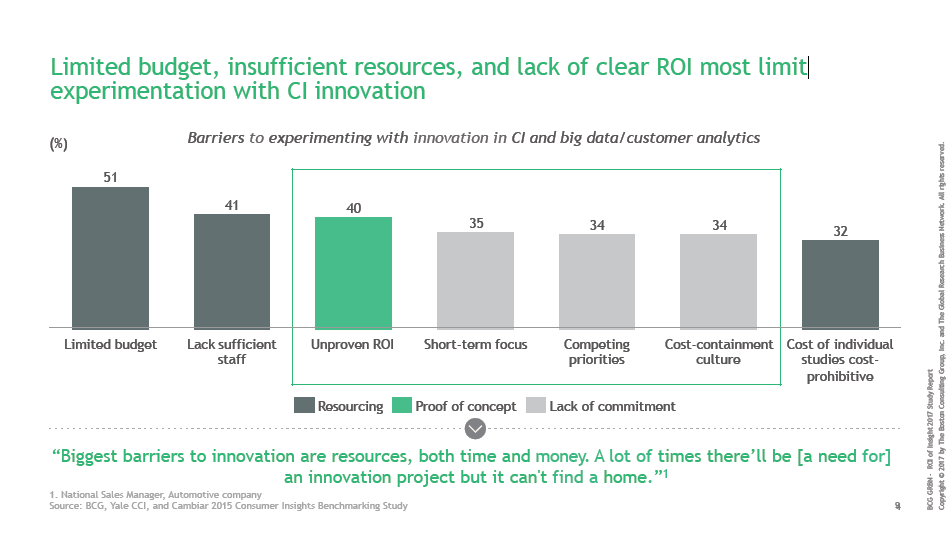

The BCG Analysis: A few years after the CEB study, BCG (Boston Consulting Group) updated their own … Click to continue reading

This seems to suggest, at least to me, a chicken-and-egg situation. Resources are insufficient because the business doesn’t see the benefit of investing in market research and insight development. However, the Market Research Department is struggling with insufficient budget and personnel to provide the support that they should – and often could – provide.

This seems to suggest, at least to me, a chicken-and-egg situation. Resources are insufficient because the business doesn’t see the benefit of investing in market research and insight development. However, the Market Research Department is struggling with insufficient budget and personnel to provide the support that they should – and often could – provide.