As consumers become more informed and discerning, the demand for brand transparency is intensifying, especially in the Consumer Packaged Goods (CPG) industry.

People want to understand where their products come from, how they are made, and whether the practices behind them align with their personal values.

This shift is pushing CPG companies to rethink how they manage and communicate their supply chains, transforming brand transparency into a strategic imperative.

However, this transformation isn’t just a matter of compliance or ethical responsibility—it’s also about enhancing the customer experience.

In a world where trust is increasingly hard to earn, brands that offer clear, detailed insights into their supply chains stand to build deeper loyalty and gain a competitive edge.

Transparency can no longer be viewed as a back-end operational detail; it’s becoming a vital part of how customers engage with and perceive a brand.

If you prefer to listen rather than read, click below.

The Rise of Consumer Demand for Supply Chain and Brand Transparency

Today’s consumers are more educated, connected, and value-driven than ever before.

With the click of a button, they can access vast amounts of information about products and companies, making them more aware of ethical issues such as environmental sustainability, labour practices, and product sourcing.

Millennials and Gen Z consumers, in particular, place a high value on buying from companies that are aligned with their beliefs.

A survey conducted by IBM found that nearly 80% of consumers say sustainability is important to them, and 57% are willing to change their purchasing habits to reduce environmental impact(BCG Global).

This trend has been amplified by the COVID-19 pandemic, which highlighted vulnerabilities in global supply chains and made consumers even more conscious of the origins and safety of their products.

For CPG companies, this means that transparency is no longer optional—it’s essential.

Brands that are unable or unwilling to provide clear, detailed information about their supply chains risk losing customers to more transparent competitors.

Supply Chain and Brand Transparency as a Customer Experience Driver

While supply chains were once viewed solely as operational concerns, they have now become integral to customer experience.

When a brand is transparent about its supply chain, it sends a message of trust, integrity, and accountability. This, in turn, enhances the overall brand perception and drives customer loyalty.

For example, consider the food and beverage sector, where consumers increasingly want to know whether the ingredients in their products are locally sourced, organic, or produced with ethical labor practices.

Brands like Patagonia and Ben & Jerry’s have built a loyal customer base by openly sharing their supply chain practices and commitments to sustainability.

Transparency creates a compelling narrative that customers can connect with, turning a purchase into a partnership.

The Role of Technology in Enhancing Supply Chain and Brand Transparency

Delivering on the promise of transparency requires more than just good intentions—it demands innovative technology solutions that allow CPG companies to … Click to continue reading

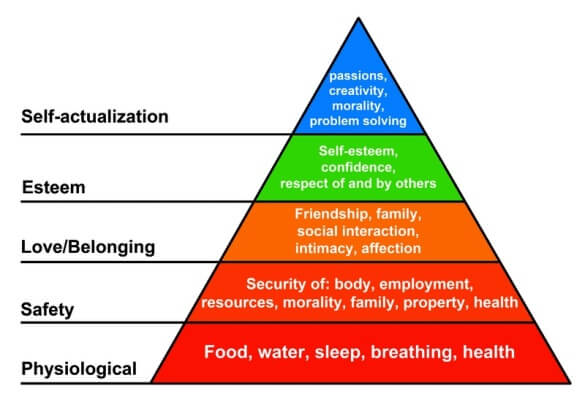

Let’s start at the very beginning – with the customer of course!

Let’s start at the very beginning – with the customer of course! They certainly have several needs, but you should aim to address only one of them.

They certainly have several needs, but you should aim to address only one of them.

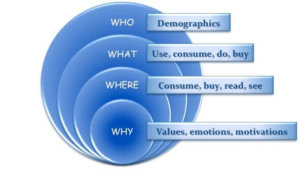

Do you know what needs your customer has and which of them you are tapping into?

Do you know what needs your customer has and which of them you are tapping into?

OK I’m starting off slowly, but do you know who your customers are? Not who uses your category, but who the people are that actually buy your product or service today? How much do you really know about them?

OK I’m starting off slowly, but do you know who your customers are? Not who uses your category, but who the people are that actually buy your product or service today? How much do you really know about them?