Many of you know that it is vital to continuously improve your customer centricity. You must put the customer clearly at the heart of your business in everything you do. But that’s easier said than done because your customers are constantly changing.

I think that’s why many businesses struggle to improve their customer centricity because they don’t know where to start. Am I right? If so, then this article is especially for you.

This week I want to share ten simple actions to accelerate your organisation’s improvement of customer centricity.

#1 Review the description of your target audience

Let’s start at the very beginning – with the customer of course!

Let’s start at the very beginning – with the customer of course!

Do all your brands have a clear description of their target audience? These days we tend to refer to these as personas or avatars. Whatever you call yours, they should be precise, detailed and ideally visual as well.

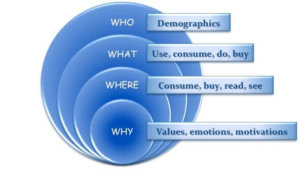

If you haven’t yet developed your persona, or you know it is not as complete as it could be, why not use our new C3Centricity 4W™ Persona Template? Complete the who, what, where and why for each of your brands and finally understand who you are aiming to attract.

I suggest you also complete one for your company if it appears predominantly on your packaging or communications. I did this for a client and found that some of their brands were positioning themselves in opposition to their company image. As you can imagine, this was getting them nowhere and damaging both their brand and company image!

Include in your own persona template not only demographics and consumption/purchasing habits, but also information about where your customers do these things, what values they have that you can tap into, and what emotions motivate them to use your brand.

If your current persona doesn’t include all this information, it is probably time to update it – and why not with our 4W™ template?

#2 Optimise how you connect with your customers

Do you know the best way to contact your target customers and their preferred place and time to connect? You should after completing your updated persona template.

Review how you communicate with your customer and what information exchange there is at that time. Is it a one-way or two-way discussion? Are you in a monologue or a dialogue?

Obviously, the second communication style is what you should be aiming for. You can learn more about your customers when they are ready to share their information. And that comes when they trust you to keep their data safe and know that you only collect what you need to give them a superior experience. Make sure that’s what you are doing.

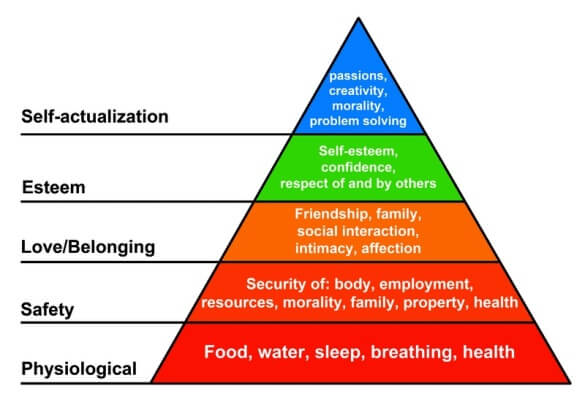

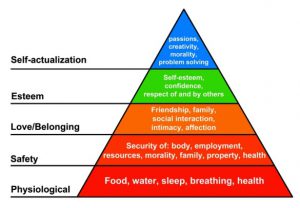

#3 Identify the needs your brand is addressing

Do you know what needs your customer has and which of them you are tapping into?

They certainly have several needs, but you should aim to address only one of them.

They certainly have several needs, but you should aim to address only one of them.

If you attempt to address more than one need at the same time, … Click to continue reading

Do you know what needs your customer has and which of them you are tapping into?

Do you know what needs your customer has and which of them you are tapping into?

OK I’m starting off slowly, but do you know who your customers are? Not who uses your category, but who the people are that actually buy your product or service today? How much do you really know about them?

OK I’m starting off slowly, but do you know who your customers are? Not who uses your category, but who the people are that actually buy your product or service today? How much do you really know about them?