As a leader, you know that customer centricity is critical to the success of your business.

However, it is not enough to pay lip service to this concept; you must make it an integral part of your company’s culture and business strategy.

In this post, we will explore what customer centricity means, why it is essential, and how you, as a leader, can successfully lead a customer-first strategy adoption in your organisation.

Defining Customer Centricity

Customer centricity is a business strategy that puts the customer at the heart of everything the company does. It involves understanding the needs and desires of your customers and then tailoring your products and services to meet them.

Customer centricity is not just about providing excellent customer service; it’s about creating a culture of customer obsession that permeates every aspect of the business. This is why it must be a company objective.

Why is a Customer-first Strategy Important?

There are several reasons why a customer-first strategy is crucial for the success of your business. First and foremost, it helps you build a loyal customer base.

When customers feel that a company truly understands their needs and is committed to meeting them, they are more likely to become repeat customers and recommend the company to others. This can help you increase revenue and grow your business.

Customer centricity can also help you differentiate yourself from your competitors. In today’s highly competitive business environment, standing out from the crowd can be challenging.

However, suppose you can demonstrate that you are genuinely committed to meeting your customers’ needs. That’s a great way to distinguish yourself from other companies that are just going through the motions.

Finally, customer centricity can help you stay ahead of the curve regarding new product and service development. By constantly seeking customer feedback, you can identify emerging trends and stay ahead of the competition. This can help you develop new offers that meet your customer’s needs today and tomorrow.

Leading a Customer-first Strategy in Your Organization

Implementing a customer-first strategy in your organization requires a significant shift in mindset and culture. Here are the steps you can take to make customer-centricity a reality in your business:

1. Start with the CEO

As a business leader, you need to lead by example.

Make it clear to your employees that customer centricity is a top priority for the company.

Set measurable goals and hold your team accountable for achieving them.

This sends a strong message to everyone in the organization that customer-centricity is not just a buzzword but a fundamental part of the business strategy.

2. Understand Your Customers

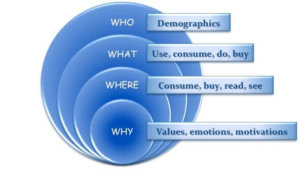

To be truly customer-centric, you need to understand your customers deeply.

This means going beyond demographic data and understanding their motivations, pain points, and desires.

Watch and listen to your customers frequently. Conduct customer research, including surveys and focus groups, to gain insights into what your customers want and need.

Collect the information in a customer persona/avatar template. If you don’t have

In most organisations today, using competitive products is still frowned upon; after all, we make the best don’t we, so why use those of other companies?

In most organisations today, using competitive products is still frowned upon; after all, we make the best don’t we, so why use those of other companies? In one of my previous positions, the company had an incredible competitive library. This included every single competitive product that was available from all around the world, classified by country and organised by segment.

In one of my previous positions, the company had an incredible competitive library. This included every single competitive product that was available from all around the world, classified by country and organised by segment.

OK I’m starting off slowly, but do you know who your customers are? Not who uses your category, but who the people are that actually buy your product or service today? How much do you really know about them?

OK I’m starting off slowly, but do you know who your customers are? Not who uses your category, but who the people are that actually buy your product or service today? How much do you really know about them?