Customer satisfaction doesn’t last as long as it used to.

We’ve all become extremely demanding, thanks to constant new offers of innovation and novelty.

Today, we want things better, faster and sometimes cheaper as well. And customer satisfaction is becoming insufficient to drive growth alone. Companies need to deliver more, a lot more!

If you’d prefer to listen rather than read:

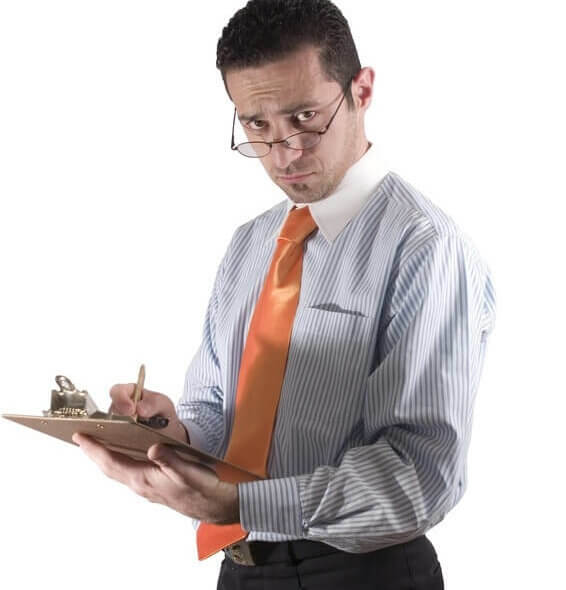

I was recently in the US, and as seems to be the norm these days, the hotel in which I stayed asked me to rate my stay afterwards. I completed their form, giving only four and five-star ratings, as I had been very satisfied with my visit, the hotel room, the staff and their services. Imagine my surprise, therefore when I got the following email a day or so after submitting my review:

“Thank you for taking the time to complete our online survey regarding your recent stay at our hotel.

On behalf of our entire team, I would like to apologize for failing to exceed your expectations. Your satisfaction is important to us and we will be using the feedback you provided to make improvements to ensure we offer an exceptional experience for our guests in the future.

I hope that you will consider staying with us again so that we can have another chance to provide you with a superior experience.”

Shocking mail, isn’t it? To think that a Hotel would apologise for not exceeding my expectations!

I believe that is exactly why they get a 4.5-star rating on TripAdvisor. For them, customer satisfaction is not enough; they want their guests to be enchanted, enthralled, and excited, so a return visit is a “no-brainer”; no other hotel choice would make sense!

So I have a question for you: How do you treat your own customers? Do you do just enough to satisfy them, or do you consistently look to exceed their expectations?

If you are a regular reader here – and I’d love to know why if you’re not, so I can do better in the future – you will know that I often talk about “surprising” and “delighting” our customers. These are not hollow words; there’s a very real reason why I use them. The reason is that our customers may be satisfied, but they will never stay satisfied for long.

The above example is one way that the hotel staff ensures they have enough time to correct whatever is not a “superior experience,” as they term their own desired service level, and to continue to offer total customer satisfaction.

Examples of Brands Going Beyond Customer Satisfaction

Here are a few examples of other companies that go above and beyond in terms of their own customer service. I hope they inspire you to do the same and to aspire to exceed customer satisfaction whenever and wherever you can.

Coming back to the title of this post, I hope you now agree that satisfaction is … Click to continue reading

In most organisations today, using competitive products is still frowned upon; after all, we make the best don’t we, so why use those of other companies?

In most organisations today, using competitive products is still frowned upon; after all, we make the best don’t we, so why use those of other companies? In one of my previous positions, the company had an incredible competitive library. This included every single competitive product that was available from all around the world, classified by country and organised by segment.

In one of my previous positions, the company had an incredible competitive library. This included every single competitive product that was available from all around the world, classified by country and organised by segment.

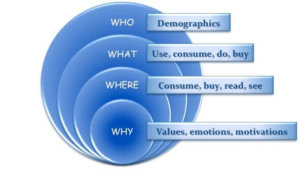

OK I’m starting off slowly, but do you know who your customers are? Not who uses your category, but who the people are that actually buy your product or service today? How much do you really know about them?

OK I’m starting off slowly, but do you know who your customers are? Not who uses your category, but who the people are that actually buy your product or service today? How much do you really know about them?