What’s your gut response to the title question about Market Research Departments? Yes? No? Being Swiss I would say it depends!

I am probably in the third camp. Yes, if it is a department that integrates and analyses information from multiple sources, and then delivers actionable insights and recommendations to the organisation. No, if it is the traditional market research department, whatever that is.

I first asked this question a few years ago and it generated a lot of – sometimes heated – discussions. Now after so many changes in the past couple of years, I thought it was worth revisiting. Please add your own perspective into the comments below and let’s get those discussions started again.

Thanks to social media and websites, the IoT (Internet of Things) and smart products, companies are inundated with information these days. Who better than market research to help in its analysis? But to become this new business decision support group, new skills are required.

Insights 2020 by Kantar-Vermeer ran some interesting research into the future of market research and insights. In their report, they spoke about the need for researchers to have five critical capabilities:

- Research & analytics mastery

- Business acumen

- Creative solution thinking

- Storytelling

- Direction setting

The fieldwork is now a few years old but I still think it makes good background reading to make companies think about their own needs in terms of data analysis. Also, the world and business environment have changed dramatically in the last eighteen months.

Another study by BCG and GRBN resulted in an Invest in Insights Handbook to help organisations report on the ROI of the insights function. They reported that those who measure the ROI of their information have found a seat at the decision table, increased budgets, and more control. Those are the department objectives that the FMCG world in particular desires today, be they in a manufacturing or retail environment.

As the handbook mentions:

“Architecting a world-class Insights organization requires executive, cross-functional commitment/engagement”

To do this, the report mentions the following six points:

- Vision & Pace

- Seat-at-the-table and leadership

- Functional talent blueprint

- Ways of working with the Line

- Self-determination

- Impact and Truth Culture

The analysis concludes that:

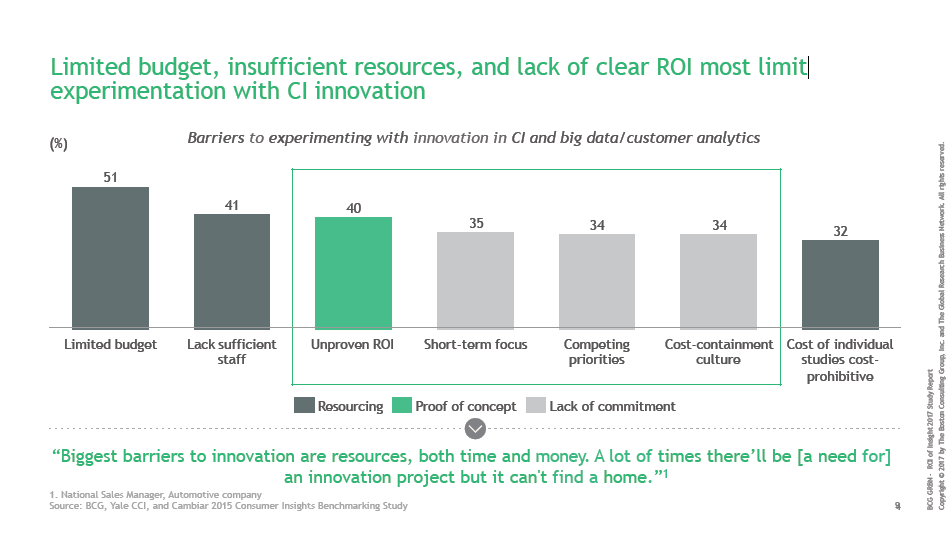

“The biggest barriers to experimenting with innovation in CI are resources, both time and money. A lot of times there’ll be [a need for] an innovation project but it can’t find a home.”

This seems to suggest, at least to me, a chicken-and-egg situation. Resources are insufficient because the business doesn’t see the benefit of investing in market research and insight development. However, the Market Research Department is struggling with insufficient budget and personnel to provide the support that they should – and often could – provide.

This seems to suggest, at least to me, a chicken-and-egg situation. Resources are insufficient because the business doesn’t see the benefit of investing in market research and insight development. However, the Market Research Department is struggling with insufficient budget and personnel to provide the support that they should – and often could – provide.

In the GRBN report, they mention the largest barriers to the measurement of the ROI of market research and insight. These were found to be:

- Difficult to do – studies are used in many different ways

- Difficulty in isolating the impact of consumer insights

- The time lag between insight delivery and business results

The secondary concerns are:

- Consumer insights distant from business decision-makers

- Business objectives not clearly defined

- Insufficient staff to measure

- Lack of alignment on important metrics

Looking at this list, it is clear that the market research profession is in need of a significant overhaul. Most local MR associations, as well as the global ESOMAR team, are all very aware of this and have set up various groups to look into it. Hopefully, we’ll see changes coming out of all those debates in the coming years.

In the meantime, I decided to propose a few ideas to get your market research and insight departments moving in the right direction, no matter where you are today.

10 Steps to Reinventing Your Market Research Department

Here are the steps that I would suggest you take, should you wish to create or optimise your market research and insights function. Feel free to add your own in the comments below. I would welcome your input.

Step 1: If you already have a market research or insights department, then the GRBN / BCG self-assessment tool is a great place to start – and it’s FREE! The link is: http://insightsassessment.bcg.com/ . This will clearly indicate both what stage of development you are in, and what you can do to improve. Invaluable! Then all you have to do is to prioritise the changes needed!

Step 2: Another assessment tool that can help you to better understand your customer understanding in its wider sense, is our own C3C Evaluator™. Again it is completely FREE, at least for the mini version, which provides an overview and summary analysis and recommended actions. The link is https://c3centricity.com/miniquiz-landing/. Unlike the insight assessment tool from GRBN, this C3C Evaluator™ tool looks at insights as the motor or foundation to adopting a customer-first strategy. As such, it considers best-practice market research and insight development as a management decision-support tool.

Step 3: Review the management’s needs in terms of customer metrics – in addition to the financial data they are already receiving. Prioritise and choose only the major KPIs (Key Performance Indicators) to follow your business vision and strategy. For a truly customer-centric organisation, these may include:

- Market and category shares

- Customer profiles

- Brand image and brand equity metrics

- Pricing, value perceptions and CLV (Customer Lifetime Value)

- Distribution and OOS (Out-Of-Stock)

- Awareness of communications

- Understanding and appreciation of messages

- Website and social media traffic, and conversion rates

- Customer retention and churn rates

- Sales funnel’s level distribution

Besides measuring your chosen metrics, trends often mean more than the numbers themselves – in many markets, the numbers will be going up anyway. Although I have mentioned many examples above, remember that KPIs mean the metrics you choose must be KEY to your business. Choose wisely so you don’t drown people in data and information. (This was in fact a problem I encountered in my previous job when working with data analysts who believed that management should have every single number, table and graphic that they came up with. They also believed that visualisation was analysis and I had many a heated discussion with them about their lack of actionable analysis! Hopefully, they finally understood after I left.

Step 4: Identify which of the metrics you already gather are important and which additional ones you need to start collecting or at least on a more regular basis. Then review methodologies and suppliers for providing all the information. If you already conduct regular tracking studies, they should be opened for pitch every few years, to avoid both sides becoming complacent and the analysis stale.

Step 5: Once the metrics are agreed upon, turn them into a one-page summary or dashboard. Most executives don’t have time for more than a rapid scan of information, so find ways to help them read it. Using traffic-light colours, graphs and one-number indices all help them to quickly understand the current situation and identify any needed actions.

Step 6: In addition to data, management will also require information about the market, its customers, competitors and retailers. This can be gathered through observation and listening, whether in person or through market research qualitative studies. Read “Five rules of observation and why it’s hard to do effectively.” for more on the topic.

Step 7: Improving your data and the information collected during market research surveys will depend upon a solid briefing document. The brief should be developed in collaboration between the internal client and the market research department. It must include at a minimum why the information is needed, by when and why. For more on how to better brief for market research studies, read “Why Marketing Doesn’t Always Get the Research It Needs, But Usually What It Deserves.”

Step 8: Identify how to measure the ROI of your research once it has been completed. Agree together on what will be considered a success before the study is undertaken. The importance of a detailed brief cannot be overemphasized as an essential part of this. It will not only allow good work to be done so the business gets the answers it needs. It also allows the measurement of its ROI using metrics agreed upon before the fieldwork even started. Knowing how the information will be used and the value of the decisions made from it, will go a long way towards proving its value. If this is only considered in retrospect, it is unlikely to meet with agreement from all concerned parties, especially when results are surprising. Therefore, these must be discussed and included in your briefing document at the start of the project.

Step 9: The next step is to build a team of supporters within the organisation with whom you regularly share all the nuggets you learn from your different analyses. Beyond answering the questions for which any research was conducted, there are always additional learnings that can be invaluable to share. Unfortunately, most Market Research Departments are so stretched that they spend most of their time behind their desks.

Even if it is just in the corridor, or during a coffee or lunch break, always have something interesting to share with your internal clients. This will quickly build respect for the MR team, which will then be seen as an invaluable source of business understanding. Of course, this does mean that the department should be involved in business meetings, but this tends to naturally come when you start sharing more with the business than mere market research results’ presentations and reports.

Step 10: The final step in optimising your market research department is to start developing insights. Although I mention this last, the 7-step insight development process I suggest to my clients involves data and information gathering only at step 6. And yet this is the one (only?) thing most MR departments are seen to do.

The reason why I mention insight development last here is that an organisation must believe in the need for a deep understanding of its customers before it can start to develop insights about them. Otherwise, its market research department will remain simply a data-gathering group. For more details about the C3Centricity insight development process, please check out our new online course and the video introduction to it: “The New 7-Step Process for Developing Actionable Insight Development.”

Et voila! To answer my question in the title of this article, my reply would be a resounding YES! Of course, I would expect your team to follow these ten steps that I believe will help all organisations upgrade their market research departments. And if nothing else, I hope you will try to complete the two assessment tools. They will give you a terrific start to understanding just how good – or bad – your department is today!

And of course, I would encourage you to watch the fun, interactive video about our new insight development course. Just click the above link to have some fun making your own personal choices in it.