Have you noticed how every technology vendor, consultant, and industry publication is telling you that your AI Strategy is the solution to all your business challenges?

The pressure to invest heavily in AI capabilities has never been greater for CPG executives.

Yet many leadership teams ask a fundamental question: How do we separate genuine opportunities from expensive distractions?

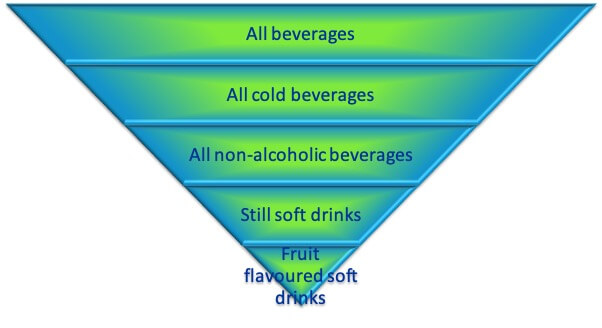

This question becomes particularly challenging when it comes to customer understanding.

While an effective AI strategy promises unprecedented insights into consumer behaviour, the path from investment to measurable business impact remains unclear for many leadership teams.

If you would rather listen than read:

The Reality of AI Strategy Investment in CPG Today

Let’s start with some sobering numbers.

According to McKinsey’s recent analysis, while 70% of CPG companies are implementing some form of AI initiative, only 22% report significant business impact from these investments.

The disconnect between implementation and value creation isn’t surprising when you consider that many companies approach AI as a technology solution rather than a business transformation.

The executives I work with often share a common frustration: they’ve invested millions in AI platforms and data lakes, yet still struggle to generate actionable customer insights that drive revenue growth.

One global beverage company CIO recently confided,

”We have more data than ever, but less clarity on what our customers actually want.”

This disconnect exists because technology alone can’t create customer understanding.

The most sophisticated AI systems are only as valuable as the business questions they’re designed to answer and the actions they enable.

Building a Strategic Framework for AI Investment

When working with CPG leadership teams, I’ve found that successful AI strategies share a common foundation: they start with strategic business objectives rather than technological capabilities.

Rather than asking “How can we implement AI?” successful executives ask:

- Which customer-related business challenges, if solved, would create substantial value?

- Where are our current gaps in customer understanding creating barriers to growth?

- How might AI-generated insights enable better strategic decision-making?

This approach shifts the focus from technological implementation to business transformation. This is a subtle but critical distinction that separates high-ROI investments from expensive experiments.

Consider how Miyoko’s Creamery approached this challenge.

As a pioneer in plant-based dairy alternatives, they faced the dual challenge of understanding both their core vegan consumers and the much larger segment of flexitarians they needed to attract for mainstream growth.

Rather than broadly implementing AI across their organization, they identified specific high-value decision points where enhanced customer understanding would drive measurable business outcomes.

They focused initially on product formulation and messaging optimization, using AI to analyze consumer sentiment around taste, texture, and functionality in both their owned channels and broader food conversations.

Their system identified that “performance” messaging (how the product melts, stretches, etc.) resonated more strongly with flexitarians than sustainability or ethical messaging.

According to Miyoko’s Series C funding announcement, this targeted approach helped them reformulate their flagship products and reframe their marketing to emphasize culinary performance. This delivered a 40% increase in repeat purchase rates among … Click to continue reading

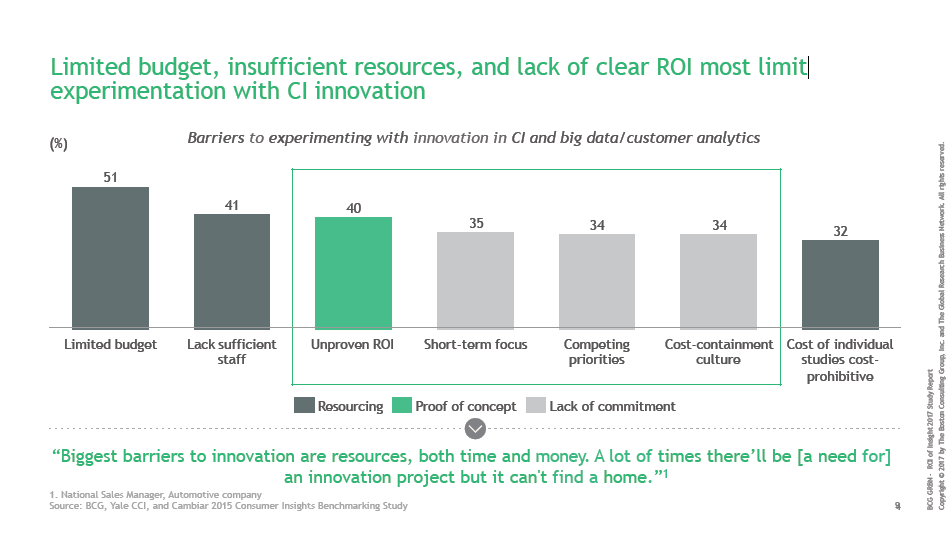

This seems to suggest, at least to me, a chicken-and-egg situation. Resources are insufficient because the business doesn’t see the benefit of investing in market research and insight development. However, the Market Research Department is struggling with insufficient budget and personnel to provide the support that they should – and often could – provide.

This seems to suggest, at least to me, a chicken-and-egg situation. Resources are insufficient because the business doesn’t see the benefit of investing in market research and insight development. However, the Market Research Department is struggling with insufficient budget and personnel to provide the support that they should – and often could – provide.