What’s your gut response to the title question about Market Research Departments? Yes? No? Being Swiss I would say it depends!

I am probably in the third camp. Yes, if it is a department that integrates and analyses information from multiple sources, and then delivers actionable insights and recommendations to the organisation. No, if it is the traditional market research department, whatever that is.

I first asked this question a few years ago and it generated a lot of – sometimes heated – discussions. Now after so many changes in the past couple of years, I thought it was worth revisiting. Please add your own perspective into the comments below and let’s get those discussions started again.

Thanks to social media and websites, the IoT (Internet of Things) and smart products, companies are inundated with information these days. Who better than market research to help in its analysis? But to become this new business decision support group, new skills are required.

Insights 2020 by Kantar-Vermeer ran some interesting research into the future of market research and insights. In their report, they spoke about the need for researchers to have five critical capabilities:

- Research & analytics mastery

- Business acumen

- Creative solution thinking

- Storytelling

- Direction setting

The fieldwork is now a few years old but I still think it makes good background reading to make companies think about their own needs in terms of data analysis. Also, the world and business environment have changed dramatically in the last eighteen months.

Another study by BCG and GRBN resulted in an Invest in Insights Handbook to help organisations report on the ROI of the insights function. They reported that those who measure the ROI of their information have found a seat at the decision table, increased budgets, and more control. Those are the department objectives that the FMCG world in particular desires today, be they in a manufacturing or retail environment.

As the handbook mentions:

“Architecting a world-class Insights organization requires executive, cross-functional commitment/engagement”

To do this, the report mentions the following six points:

- Vision & Pace

- Seat-at-the-table and leadership

- Functional talent blueprint

- Ways of working with the Line

- Self-determination

- Impact and Truth Culture

The analysis concludes that:

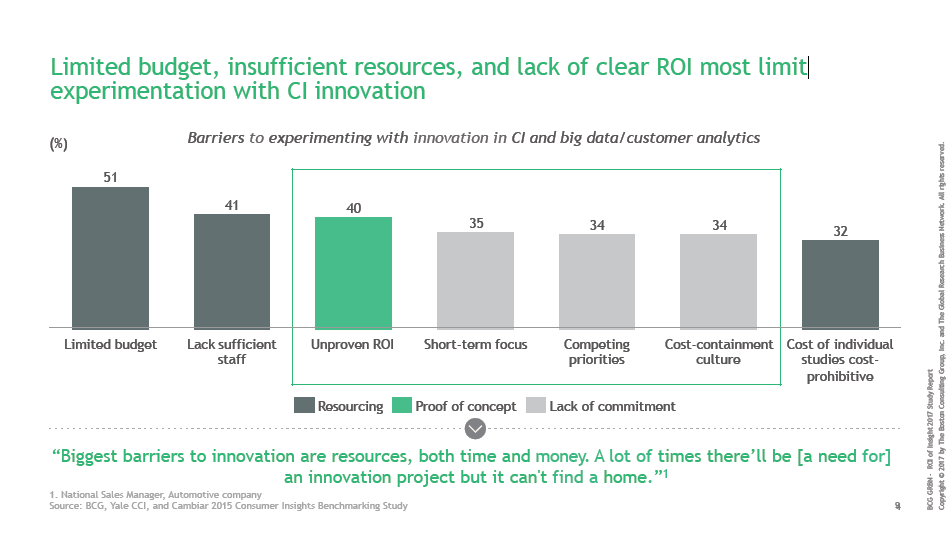

“The biggest barriers to experimenting with innovation in CI are resources, both time and money. A lot of times there’ll be [a need for] an innovation project but it can’t find a home.”

This seems to suggest, at least to me, a chicken-and-egg situation. Resources are insufficient because the business doesn’t see the benefit of investing in market research and insight development. However, the Market Research Department is struggling with insufficient budget and personnel to provide the support that they should – and often could – provide.

This seems to suggest, at least to me, a chicken-and-egg situation. Resources are insufficient because the business doesn’t see the benefit of investing in market research and insight development. However, the Market Research Department is struggling with insufficient budget and personnel to provide the support that they should – and often could – provide.

In the GRBN report, they mention the largest barriers to the measurement of the ROI of market research and insight. These were found to be:

- Difficult to do – studies are used in many different ways

- Difficulty in isolating the impact of consumer insights

- The time lag between