Marketing often jumps from information to insight, to the frustration of market research. But the best marketers know that closer collaboration and sharing enables greater underst anding and deeper insights.… Click to continue reading

Tag: Marketing

How Marketers Can Benefit From More Than Technology: Modern Marketing

Just like most entrepreneurs and business people, I go to my fair share of conferences. I believe that marketers can benefit from being regularly challenged by new thinking and ideas.

One that stays in my memory for many reasons, was an event I attended in San Jose, California. Some say California is the centre of internet marketing; the San Francisco area for technology and San Diego for marketing. I tend to agree after having recently attended events in both cities.

The conference that changed many of my views on modern marketing was one about how business people, not just marketers, can break through our self-limiting behaviours. It is this idea which prompted today’s post. How we marketers can relinquish our well-established thoughts and actions to make our businesses grow more profitably. If this is of interest to you too, then read on.

HEART-CENTERED VERSUS CUSTOMER-CENTRIC

The conference I attended in San Jose was a great opportunity for me to meet many other people from around the world. People who want to make their businesses more heart-centered. You know that I am a champion of customer centricity. I love to support companies that want to put their customers at the heart of their businesses.

So you might be wondering what the difference is between a customer-centric and a heart-centered business. After the conference, I would say that in my opinion, not much. I believe it is difficult to think customer first without it also involving the heart; at least, it should.

As we try to put our customers at the centre of our organisations, it is through a concern to satisfy and delight them. A heart-centred business would probably go even further to ensure that what they do also benefits non-customers, or, at least, doesn’t harm them.

Creating shared value has become a strong commitment of many of the leading global players in the consumer goods market. Reliance Jio, Merck and Bank of America lead the way according to the Fortune “Change the World” List.

If the topic inspires you then you might also be interested in reading an article on “Innovation and Creating Shared Value”, which I was invited to contribute to one of the first issues of the Journal of Creating Value. I will also be speaking at the 2nd Global Conference on Creating Value in New York later this year. So let me know if you too will be attending and we can meet up.

CUSTOMER FIRST EXAMPLES

But back to defining the types of business. Which is yours? Heart-centered or “just” customer-centric? Or are you not even there yet?

Do you think customer first but forget about those who are not yet your customers? That’s a dangerous thing to do as you may be limiting your brand’s potential. Here are a few current habits that some companies have, which show how customer centric they are – or not:

- Asking credit card details for a “free” offer. This

Top 10 Marketing Infographics to Smash 2018 (Inspiration for the Visual World)

One of C3Centricity’s annual traditions is to publish a post which shares the best marketing infographics of the previous twelve months.

Here is this year’s crop, with ideas on how you can get inspired to take action in your own marketing.

Interestingly, many marketing infographics that have been shared in the past year are actually about content marketing. It’s as if “true/traditional” marketing doesn’t exist any more. That in itself says a lot about the focus of marketers these days! Are they right to do so? I don’t think so, but let me know your opinion.

In the same way that new media channels were separated from traditional channels for a while. it seems that content marketing has also been separated from traditional marketing. This is wrong from my perspective, because content marketing has always existed, whether through communications on pack, in advertising or more recently on websites.

Anyway, here is this year’s crop of the best marketing infographics around. If yours is not among them then please add a link to your preference in the comments below.

The Most Shared Marketing Infographics of 2017

It makes sense that I start this post by taking a look at the most shared marketing infographics of last year. What is great about this post is that it is itself an infographic! It explains what makes a shareabale infographic.

Take a look at the six most shared posts and draw inspiration from their ideas, to create your own.

(Click image to see full infographic)

With the rapid expansion in offers online, websites can no longer satisfy their audience by just adding content. They need to regularly update their design too, to stay fresh and appealing to changing preferences. (C3Centricity does this annually; le me know what you think when we relaunch our new design in a couple of weeks)

With the rapid expansion in offers online, websites can no longer satisfy their audience by just adding content. They need to regularly update their design too, to stay fresh and appealing to changing preferences. (C3Centricity does this annually; le me know what you think when we relaunch our new design in a couple of weeks)

This infographic summarises beautifully the trends for the coming year. Check your own site against these images and if you find yours lacking in any way then an update should be planned – sooner rather than later!

(Click image to see full infographic)

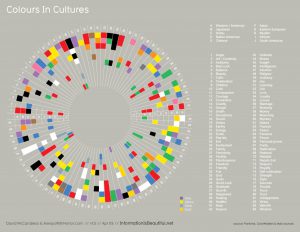

The Meaning of Colours by Culture

If you work globally then you already know that while we are all human beings, we are not all the same. This is particularly true in terms of our associations with colour.

If you work globally then you already know that while we are all human beings, we are not all the same. This is particularly true in terms of our associations with colour.

These differences come from a wide variety of sources; from tradition, to history and even from the impact of the most popular brands.

So it is important that if you are responsible for a brand globally, or sometimes even regionally, that you understand the nuances in interpretation of your brand’s pack and communication by the colours used.

This infographic, while it may seem complex at first view, will become your best friend once you understand how to look at it.

(Source: Information is Beautiful)

(Click image to see full infographic)

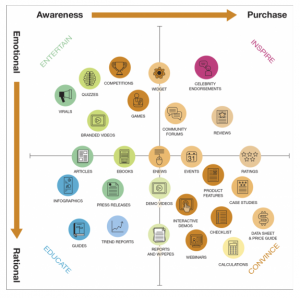

Content Marketing Uses

This is a … Click to continue reading

Why You Struggle To Meet Your Business Objectives (And how to Crush them)

“There may be customers without brands, but there are NO brands without customers!”

I am often quoted as saying this and yet I still find most companies spend more time thinking about their brands than their customers, which is alarming to say the least! And you?

Last week I spoke about identifying the exact category in which you are competing. If you missed it, then I suggest you read “You’re Not Competing In The Category You Think You Are!” before continuing. You will never be successful if you don’t understand the category people put you in and the competitors they compare you to.

In the post, I explain that we often work with a category definition that is based upon industry norms rather than that of our customers. For instance you might segment by price or demographic groups, whereas your customers group brands by flavour or packaging.

Understand how customers see the category and its sub-segments can make a huge difference to your success in satisfying your own target customers.

This week I want to continue the theme of taking the customers’ perspective by speaking about our own business objectives. You know, the topics that make up our business and marketing plans with such lofty ambitions as:

- Grow our market share to X%

- Become the category captain/leader in Retailer Z

- Launch three new brand variants

All of these may be valid business objectives, but they are not customer focussed. They start from the business perspective.

Adopting a customer-first strategy means turning business objectives into customer aims, by taking what is sometimes referred to as a bottom-up, rather than a top-down approach.

Here are some questions to help you identify your customers’ aim, their attitudes and behaviours that you are trying to influence:

1. Who are you targeting?

Every brand has a target audience. This is a sub-segment of all category users. Yes, you do need to segment users and target the most relevant and most profitable group of them for your brand, and then ignore the rest. If you are trying to appeal to everyone you end up pleasing no one!

“If you are trying to appeal to everyone you end up pleasing no-one!”

2. Why are they currently using your competitor’s brand?

In order to attract your competitors’ customers, you need to understand their motives, why they are preferring the competitive brand to your offer. This information can come from many sources, such as market research, social media, or care centre contacts.

3. What reason might make them consider switching?

If you are to appeal to your competitors’ customers then you must be able to satisfy them at least as well, and ideally better than does their current brand. What do you know about the criticisms customers have of the brand? What benefits do you offer and they don’t, or only partially? Could these be appealing to some of their customers?

4. Why do you believe that you can appeal to them now but didn’t before?

Do you have … Click to continue reading

You’re missing out on A Free Communication Channel! (Any guesses what it is?)

“Never miss an episode. Subscribe on Apple Podcasts to get new episodes as they become available.”

Are you as shocked as I am, to think that there is a free communication channel which most marketers are not using effectively today?

So what is this incredible channel? The Internet? No. Social Media? No.

OK, so everyone is excited about the web and have jumped on board the digital train. But some are already seeing that online advertising is not the “safest” way to communicate.

Take P&G for example. A recent AdAge article stated that:

Procter & Gamble’s concerns about where its ads were showing up online contributed to a $140 million cutback in the company’s digital ad spending last quarter…

P&G didn’t call out YouTube, the subject of many marketers’ ire earlier this year, … but did say digital ad spending fell because of choices to “temporarily restrict spending in digital forums where our ads were not being placed according to our standards and specifications.”

Will others follow? I don’t know. But I would like them all to reconsider their total advertising spend in light of this underutilised but highly effective channel that I’m about to share with you. Have you guessed what it is yet? It’s packaging!

Think about it. Packaging communicates in-store, on the shelf as shoppers pass by.

It communicates to users when they take it home and open it. Although for how long? See below for some developments in that area.

And it may also communicate when it’s used, whether it is snacks, drinks, breakfast cereals, cookies, pharmaceuticals or a whole load of other products which are consumed straight from the pack.

So if a pack has the possibility to communicate, why are so few marketers using it?

I believe it’s because they don’t see packaging as a communication channel, which is a serious mistake. After all, it’s free!

There are two very popular posts on C3Centricity on the topic, which you might like to read before continuing. The first is “How Communicating through Packaging is more Informative & Personal” which shares some great examples of how creative pack usage has become the basis of full media campaigns. Click the link above to read more.

The other is “Is your Packaging Product or Promotion?” which talks about why people don’t read instructions – until they need them – but they do read what’s written on packs. Click above to read more.

Both of these posts provide some great examples of companies which have used their packaging to communicate with their consumers. However they are a couple of years old now, so I wanted to update my thoughts on the packaging channel opportunities, as well as the examples I share.

After all, customers have become more demanding in recent years and want to know far more about the products they purchase.

And if you can’t wait to start a review of your … Click to continue reading

Why Customers Are The Answer To All Your Problems (If You Ask the Right Questions)

Last week I asked whether it is employees or customers who are more important to an organisation. If you missed it read “Customers Care About a Product’s Value, Not How the Company Treats Employees” now and catch up.

I knew it would be a provocative question but I still didn’t expect quite so many comments! So this week I decided to be just as provocative and talk about the issues that challenge many businesses. And where the answer to whatever problem they have is actually quite simple. For me, customers are the answer! They can either answer or help you overcome any challenge or issue you may have. Read on and then let me know if you agree.

How can I innovate more successfully?

- Audacity and grit: The determination to continue despite failure. And I would add the acceptance of failure and the license for employees to fail too.

- Strong leadership and true collaboration: An inspiring vision and the tenacity to make it happen – together.

- Give employees autonomy. We all need meaningful work. The chance of helping an organisation grow is what motivates top employees. That and the freedom to make decisions based on clear goals but without directive processes on how to meet these objectives.

- Build platforms, not products. This may be the hardest for

Does your Organisation Really Need a Market Research Department? And in the Future?

There’s been a lot of talk recently about New Marketing; how communication is now all about engagement, how the consumer is boss and such like.

But there has been very little said about a New Market Research Department! If you’re concerned by this situation, whether you work in marketing, market research or a completely different area, then read on for some thoughts on how this situation can and must change.

Earlier this year I wrote about the future of market research / insight departments and what researchers need to do within their organisation to improve their image and perceived value. This week I want to take a wider look at the profession in general.

Current Perception of Market Research

According to Wikipedia, Marketing is “The process of communicating the value of a product or service to customers, for the purpose of selling the product or service. It is a critical business function for attracting customers” The definition of Market Research is “Any organized effort to gather information about markets or customers. It is a very important component of business strategy”.

What is interesting in comparing these two definitions is the difference in appreciation of the value to business of the two. Marketing is said to be a “critical function”, whereas Market Research is said to be “very important”. Perhaps this is why Market Research Departments continue to be hammered, their budgets are constantly under pressure and their value to the business is questioned.

Well, things are about to change, or at least there is an opportunity for this, if researchers take up the incredible chance offered to them in today’s world of information (over?) abundance. You can’t continue to do the same old same old when marketing, and more importantly the consumer, is clearly on the move.

What Business gets from Market Research

I think that one of the biggest problems that Market Research has (continues to have) is that Marketing and Management in general, find it too complex. What is often delivered from market research, BY researchers, tends to be numbers and findings, not underst anding, insight and recommendations.

We no longer need market research to share the numbers and information today. More and more often, these are coming automatically into companies from an ever-growing number of sources, and a lot of it is even in real-time, something market research results never were! Think sensors on products, GPS on smart phones, retail purchases with debit / credit / loyalty cards, social media interactions …. DataShaka recently wrote in their The Lab an interesting perspective on data management and information sources which you might want to check out.

That’s a lot of data; indeed Aaron Zornes, chief research officer of The MDM Institute, was recently quoted in Information Management as saying that “a typical large company with (has) 14,000 or so databases on average”. And most of that data will be just sitting around in IT storage systems, rarely reviewed and even … Click to continue reading