Will the future of retail be without physical outlets?

I remember having a very interesting discussion with a new client a couple of years ago on exactly this topic. Like many CPG companies at the time, they were considering online retailing. They were already selling a little online but hadn’t seriously considered it until then.

However, with the move of most major supermarket chains to offer online stores too, plus a few successful online-only stores, such as Amazon in the US and Ocado in the U.K. they were reconsidering just how big they could or should grow their online business.

This discussion happened just a few years back in 2017. Today the question is no longer asked. The pandemic has forced most customers to buy online, at least during the various lockdowns. And many have found the experience both enjoyable and useful.

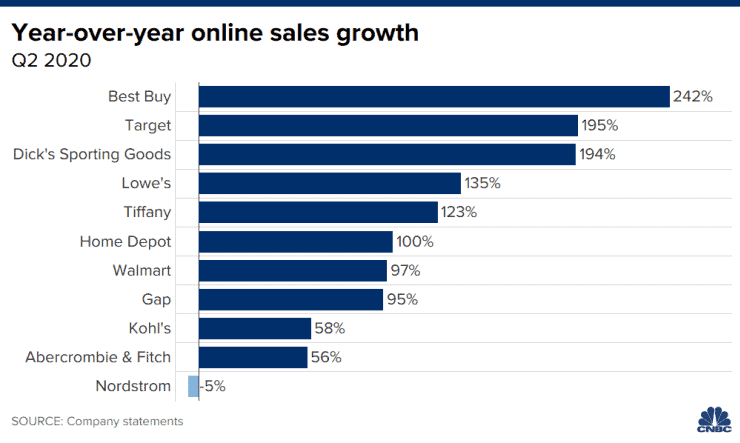

A recent article on CNBC showed that many major chains in the USA had recorded triple-digit growth in online sales in the first half of this year. But they rightly questioned whether the trend would continue into next year.

They concluded by saying that those retailers who had already invested in online sales would fare better than those forced into it by the pandemic. I agree, as the change in customer behaviour was so fast that it was difficult for those retailers who were not prepared, to catch up and move their sales effectively online.

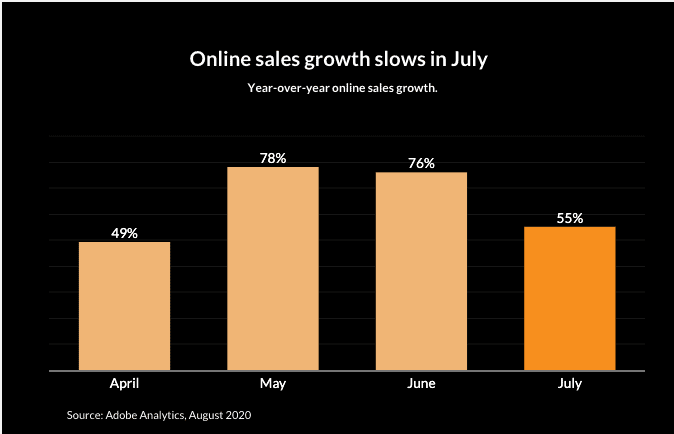

However, they argued that people would return to bricks and mortar stores once the lockdown eases and Adobe has found some data that may just confirm this. E-commerce growth appears to be slowing, as the below graph shows.

I remember participating in heated arguments in the past, between sales teams and retailers, about online stores. Retailers thought that it was unfair competition and threatened to delist a manufacturer’s products if they sold direct. No wonder my client at the time had been scared to develop this area, as in fact were most other CPG companies.

Just a few years ago, Amazon was said to be muddying the waters by testing their new Fresh delivery and Go bricks and mortar outlets. Walmart retaliated with a competitive online offer of fast service and free delivery. The battle had begun and today we see nothing more than an acceleration of the trend that started almost a decade ago. At least that’s my opinion; what do you think?

The case for bricks & mortar stores

An excellent article published mid-2017 in Forbes andentitled “Five Signs That Stores (Not E-Commerce) Are The Future Of Retail” concluded that physical stores are more valuable. Of course, that was three years ago, an eternity especially post-covid! However, it does highlight the importance of scenario planning for preparing an organisation for future opportunities and threats. For me, planning for the future is as simple as taking the consumers’ perspective and understanding what they (will) want.

For example, I’m happy to order my usual brands online and have them delivered, especially when they’re cumbersome, like pet food, drinks, tinned and paper products. However, for some items, particularly fresh produce, I like to be able to pick the leanest meat or the freshest fruits and vegetables. And you? Do you have sourcing preferences by category? I bet you do, just like other customers.

We will always need to see and try before we buy in numerous categories. Offering free returns may work for apparel but not for electronics. In several industries, consumers will want to see, compare and appreciate items before they purchase.

Several home improvement brands and stores are already offering apps which allow customers to see their potential purchases in their homes. Or their paint and fabric choices “in situ” but virtually. So are retail outlets really essential for every category?

Brian Solis wrote a great article also in early 2017 on the “11 Trends Shaping The Future Of Retail” based on a presentation he wrote back in 2015! However, despite their age, I feel that they remain as true today as when he wrote it.

He says that retail continues to suffer from what he calls the new “Kodak Moment.” This, he claims, is the moment when executives fail to see how customers and markets are shifting.

Here are the trends Brian mentions:

1. New (human) perspective is needed to see the actual future that is playing out.

2. Cater to “Accidental Narcissists” as I call them and compete in the on-demand economy.

3. Compete for customer experience…not CX…there’s a difference and one is customer-centered.

4. Become payments agnostic. Don’t impose false standards to compete against other systems to reduce fees. Be open.

5. Understand social commerce and design targeted initiatives that drive shared experiences, reviews and referrals online.

6. Invest in the trust economy, be transparent, and earn reciprocity through the facilitation of open engagement and commerce.

7. Balance web rooming and showrooming by investing in mutually-beneficial experiences and outcomes on both sides.

8. Explore new technologies to reimagine the in-store/online experience blurring the lines between digital/brick-and-mortar.

9. Study the digital and specifically the mobile customer journey to uncover friction, update ageing touch points and cater to mobile-first and mobile-only customers.

10. Invest in innovation teams or innovation centres to discover new competition and possibilities to test and learn in more rapid prototyping programs (outside of risk-averse culture).

11. Take a fresh look at space and consider it a blank slate. Ask yourself and your team, what if we could build a physical store that brought the digital and real-world together to deliver intuitive and indispensable experiences? That’s what Amazon is doing.

What I love about this list is that in the end it can be summed up very simply. It is essential to both know and understand your customers. And it is fundamental for businesses to treat their customer as they would want to be treated themselves. Isn’t that what business has always been about? And life too, come to think of it! So why should retail by any different?

The future of retail

What is sad, in my opinion, is that the vast majority of retailers – and CPG companies too – have been playing a “wait and see” game. And the pandemic has caught them napping. In so many areas, they thought that adding a few technical gadgets or an app or two would enable them to continue to attract customers. Things have gone far beyond payment options or mere personalisation of the shopping experience these days. Covid has changed what people want and how they want to purchase it.

I, therefore, decided to summarise some of the key changes which I believe have become essential to answer customers needs in this era of reset and reboot:

Convenience: customers have busy lives and prefer less and less to go for the large weekly shop in out-of-town shopping malls and hypermarkets. This is why smaller stores in strategic localities will develop faster in developed markets.

There will also be a clear differentiation by category. The customer will decide on their personal priorities between what they value most between their time, price and convenience. For some products, and not just the more expensive ones, they will make an effort in choosing, for others they will expend very little energy.

This has always been the case and is the reason why some manufacturers strive for 100% distribution. But in the future, distribution should be linked to convenience for the customer, not just mass presence. This is also where customers will weigh the convenience of a visit to a store against the risk of contracting the virus. Shopping times will also change as customers alter their behaviours, whenever possible, to avoid crowds.

Experience: while some shopping malls are in decline, especially in the US, those that survive will shift the emphasis from purchasing to more varied experiences. By incorporating cinemas, bowling alleys, cafes, restaurants and even medical centres, malls are hoping to attract customers by differentiating themselves and driving more traffic to them. But just how different they can be from each other is becoming relatively limited.

However, the retailers themselves also need to start selling differently. Apple, Nike and a few others have already done this. But most outlets appear to be oblivious to the change in their customers’ desires for experiential connections with brands. As health and safety become top-of-mind for shoppers, they may avoid these in the short-term as they prioritise pre-visit decision-making, enabling quicker in-store visits.

Delivery: Whether we buy online or in-store, one thing is clear; we want it NOW! Fast these days is next-day or same-day delivery – if ordered before a certain time. In the very near future, we will want our purchases to be waiting for us when we get home. Already a quarter of shoppers, according to recent L2 research said they would abandon their cart if same-day delivery was unavailable. And with many customers still in lockdown or working from home, the pressure on delivering fast becomes even stronger.

If you think about it, why should shopping be any different from transport today? We no longer stand on street corners in the hope of finding a taxi driving by. The success of Uber and Lyft lies partly in the fact that the customer can call a car and immediately know the waiting time based on a live map of their surroundings. They also know the plate number, driver’s name and what others think about the person. All this delivers trust in the experience, an essential part of going out these days when each excursion carries the additional risk of possible infection.

Another aspect of delivery that is changing is its timing. As Lin Grosman says in her article The Future Of Retail: How We’ll Be Shopping In 10 Years: “Of course, that’s just the beginning. Two-hour drone delivery is coming in the foreseeable future, and Amazon is already talking about 30-minute drone delivery.” Talk about near-instantaneous gratification!

The other advantage of such methods is the lack of dealing with delivery people and the latent risk of contamination. Now I’m not sure that this is a great direction for humanity. We all know that we value things more if we have had to work or wait for them. Are we moving rapidly to a new type of consumerism where taking people out of the equation whenever possible will become an increasing preference for shoppers?

Choice: We now all know what is available around the world, thanks to the internet. Our desires are no longer limited by what is available in local stores or even in our own country. We want to have the choices that others have, wherever in the world we may live.

Customers are already ordering online from far and wide; pet care from Australia, fashion from France and technology from China. It is then up to the purchaser to compare not only the prices but delivery costs and timing as well when making their choice.

According to research conducted by Walker, it was forecast that by the year 2020 customer experience will overtake price and product as the key brand differentiator. Amplexor recently confirmed that this has in fact already happened, at least in B2B. They claim that:

“Customer experience has overtaken price and product as the key brand differentiator for more than 80% of businesses.”

From that perspective, outlets have arguably an easier task to make the shopping experience more enjoyable and memorable. These days it’s certainly more memorable but probably not more enjoyable, which is why online shopping has increased so dramatically. However August saw a slight decline in the growth of online sales in both the US and UK, as people start returning to brick and mortar stores. But it is clear that covid has changed our purchasing behaviours far faster than the previous trend was showing.

Values: Both manufacturers and retailers are being held to higher standards that have far more to do with their values than their products and services. Millennials, in particular, are basing their choice of brands on things such as social responsibility, sustainability, transparency and authenticity.

Corporate reputation is being scrutinised and evaluated at each mention in the press or on social media. Organisations that don’t walk their talk will be rapidly found out and publically discredited. The pandemic has added one further criterion of importance, that of how organisations are treating their employees. Never before have businesses been scrutinised so closely for their behaviours in so many areas!

Conclusion

So what is the future of retail? Physical or virtual? Are we just in a reset or are we facing a reboot of much larger proportions? With some retailers banking on the first and others on the second, it’s going to be an interesting ride. The customer has everything to gain, at least in theory. Bigger choices in products, services and prices, for sure, but perhaps not always better. And safety has now joined trustworthiness, carbon footprints and sustainability of business practices as a way of evaluating companies and their brands.

I believe that this is why organisations are pulling back their finance departments and care centres from India. And why China is in a race to transform itself from the manufacturer of the world to a global innovation hub. Will the alleged source of the pandemic hurt their image? Most certainly, but for how long? Few countries can compete on price, speed and now even quality.

Retail has always been about making sure that “the right product, is in the right place, at the right time, at the right price.” The right place at the right time appears to be gaining ground over the other two. What do you think?

This post has been regularly updated to reflect current sensitivities in the market. The original post appeared on C3Centricity in 2017.

I like the way you have a “ready-made” tweet available to click on. I’d like to do the same. How is this set up to operate?

Hi William,

Thanks for your appreciation.

There are many plugins that will do this for you.

I use Better Click to Tweet now, but have tried many others.

Just check out the plugins and see which one you like the use of.

Very easy installation, of course.

Good luck,

Denyse