The first step of any business is to identify the category in which they are competing. This may surprise you, but you’d be amazed just how many brands are not in the category they think they are. When was the last time you checked how your customers saw you?

Just think about the consequences of an incorrect attribution; you would be concentrating on competitors that your customers never compare you with! And you would waste resources defending yourself against the wrong brands. Talk about squandering valuable resources! That’s why I decided to dedicate a whole post to this important topic.

But before I get started, I suggest you first read the post (Customer Centricity is Today’s Business Disruptor, Insights its Foundation) as background information. In it you’ll discover the full description of the seven steps of the CATSIGHT™ process, which I know will also be useful to you. In the article, I summarise the very first step of Insight development, that of category definition, like this:

C = Category

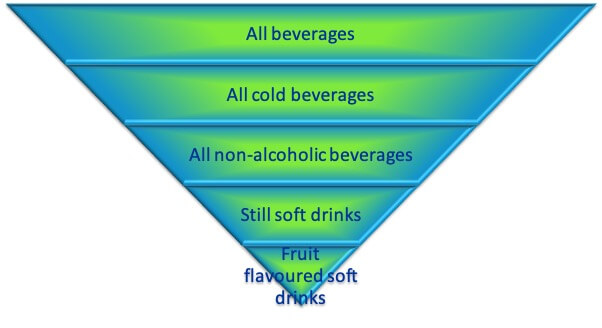

Whenever you want to develop an insight, the first task is to decide on the category you want to study. This may seem obvious to you, but in many cases, it isn’t as clear as you might have thought.

For instance, suppose you are planning on launching a new fruit-flavoured soft drink. You may think that you are competing with other juices or perhaps other soft drinks. But rather than just assuming the category in which you are competing, I highly recommend that you check; you may be very surprised.

In working with one client who was in this exact situation, we actually found that their main competitor was an energy drink!

Step 1. What is the category definition you are currently using?

In any process, we should always start by identifying where we are today. In the case of your category definition, it should be the … Click to continue reading