EXECUTIVE SUMMARY: Consumer relevance begins with superior listening. The evidence shows that success belongs to those who can hear consumer needs before consumers fully voice them, precisely the capability that separates market leaders from market followers in every category.

If you would rather listen than read:

Consumer behaviour now shifts faster than quarterly reports can capture it, leaving CPG executives facing an uncomfortable truth.

Traditional market research methods are failing to keep pace with the speed of consumer evolution. Recent Bain surveys reveal a striking disparity: 84% of executives in other non-tech industries count generative AI among their top five priorities, while only 37% of CPG executives share this conviction.

This hesitation emerges at a critical moment when the primary challenges for 2025 include increased competition for shoppers, decreased consumer spending, and intensified pressure from retailers.

The companies that are listening smarter through AI aren’t just gaining operational efficiencies — they’re rebuilding the fundamental connection between brand and consumer that drives sustainable relevance.

Having been a beta tester for ChatGPT and now working daily with AI-powered solutions across my consulting practice, I’ve witnessed firsthand the evolution from experimental novelty to essential consumer intelligence capability.

The companies I advise that have embraced sophisticated AI-enabled listening are consistently outperforming those still relying on conventional research methods to understand their rapidly changing consumers.

The Relevance Crisis: When Consumer Insights Lag Behind Consumer Reality

The data reveals a sobering disconnect between CPG brands and their consumers. Only 7% of US online shoppers are members of a CPG brand’s loyalty program, compared to the vast majority enrolled in retailer programs. This gap signals more than a marketing challenge—it represents a fundamental breakdown in consumer understanding and connection.

Consider the stark reality facing today’s CPG leaders: consumers have definitively rejected the price-increase playbook that sustained growth through 2023.

As Bain & Company’s research demonstrates, consumers are now switching to private-label brands, waiting for promotions, or simply buying less when faced with price hikes that offer no additional value.

Conventional consumer research, with its quarterly cycles and retrospective analysis, cannot capture these sentiment shifts quickly enough to inform real-time strategy adjustments.

Meanwhile, consumer behavior complexity has reached unprecedented levels. McKinsey’s analysis shows notable disparities between income segments, with older, high-income consumers driving discretionary spending while price-sensitive segments increasingly scrutinize every purchase decision.

The traditional demographic and psychographic segmentation models that guided CPG strategy for decades now feel woefully inadequate.

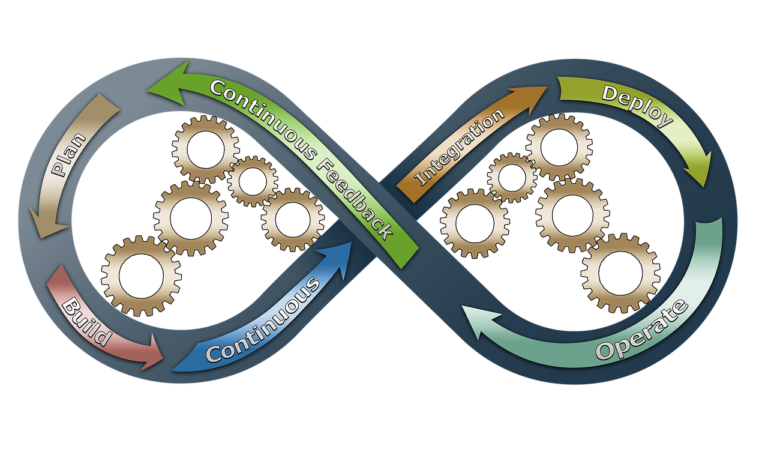

The AI Listening Revolution: From Data Collection to Consumer Understanding

The most sophisticated CPG companies are discovering that AI’s true power lies not in automating existing research processes, but in fundamentally reimagining how brands listen to and understand consumers.

Procter & Gamble’s groundbreaking collaboration with Harvard Business School provides compelling evidence of this transformation.

In their comprehensive study involving 776 employees across commercial and R&D functions, P&G found that teams leveraging AI-powered consumer insight generation worked 12% faster than traditional research teams.

More significantly, these AI-augmented teams developed more balanced solutions that better reflected diverse consumer needs, regardless of individual team members’ expertise limitations.

“This study affirms what we’ve long suspected: AI is a game-changer for innovation,”

noted P&G’s Chief R&D and Innovation Officer Victor Aguilar.

“Whether employees are analyzing consumer sentiment solo or collaborating on insight synthesis, AI provides a powerful boost, unlocking new consumer understanding and accelerating our speed to market relevance.”

The productivity gains represent only the beginning. P&G’s teams discovered that AI enabled them to process consumer feedback, social sentiment, and behavioral data in real-time, creating a dynamic view of consumer needs that conventional research methodologies simply cannot match.

Unilever’s Consumer-Centric AI Ecosystem: Listening at Scale

European leader Unilever demonstrates how systematic AI implementation creates unprecedented consumer listening capabilities.

With over 500 AI applications deployed globally and 23,000 employees trained in AI usage, Unilever has built what amounts to a real-time consumer intelligence nervous system.

Their AI-driven customer connectivity model, developed in partnership with Walmart Mexico, illustrates this listening approach in action. By analyzing consumer purchase patterns, seasonal preferences, and demand signals in real-time, the system achieves above 98% on-shelf availability while reducing inventory waste. This isn’t just supply chain optimization—it’s consumer need anticipation at scale.

In Unilever’s ice cream division, AI systems analyze weather data alongside historical purchase patterns to predict consumer demand with 10% greater accuracy than traditional forecasting methods.

The insight goes beyond simple weather correlation: AI identifies micro-trends in consumer behavior that human analysts might miss, such as how specific temperature changes in different regions correlate with preference shifts between product categories.

Perhaps most importantly, Unilever’s approach extends to product development itself. Their AI systems analyze consumer reviews, social media sentiment, and usage patterns to inform new product creation.

One beverage innovation, developed using AI-generated consumer insights, reduced time-to-market by 60% while achieving higher consumer acceptance scores than traditionally developed products.

The Consumer Data Revolution: From Guesswork to Precision

The financial implications of superior consumer listening are substantial.

McKinsey’s analysis of more than 140 digital and AI use cases across the CPG value chain reveals that companies successfully implementing AI-powered consumer intelligence can generate 6-10% incremental revenue uplift and 3-5 percentage points in EBITDA growth over three to five years.

For a $10 billion food and beverage company, this translates to $810 million to $1.6 billion in value creation. The largest potential impact—valued between $230 million and $470 million—lies specifically in customer and channel management, where real-time consumer understanding drives more effective engagement strategies.

McKinsey’s research estimates that generative AI applications in consumer understanding could increase the economic impact of traditional AI by 15-40%, unlocking an additional $160-270 billion annually in profit for CPG companies globally.

This value creation stems not from operational efficiencies alone, but from the superior consumer insights that drive more relevant product development, more effective marketing, and more profitable pricing strategies.

Looking to Reignite Momentum in Your Career or Company?

We should talk NOW!

The Six Pillars of AI-Powered Consumer Intelligence

Leading CPG companies have identified six critical capabilities for building sophisticated consumer listening systems:

Real-Time Sentiment Analysis: Moving beyond quarterly consumer research to continuous monitoring of consumer sentiment across social media, reviews, and digital interactions. AI systems can detect sentiment shifts weeks or months before traditional research methods.

Predictive Consumer Modeling: Using AI to anticipate consumer needs and preferences before consumers themselves fully articulate them. This includes analyzing behavioral patterns, purchase sequences, and engagement data to predict future preferences.

Personalization at Scale: Leveraging AI to understand individual consumer preferences while identifying broader pattern trends across segments. This enables mass customization strategies that feel personal while remaining economically viable.

Cross-Channel Consumer Journey Mapping: AI systems that track and analyze consumer interactions across all touchpoints, from social media engagement to in-store behavior, creating comprehensive understanding of consumer decision-making processes.

Dynamic Pricing Intelligence: Using AI to understand price sensitivity through real-time analysis, moving beyond static elasticity models to dynamic pricing strategies that reflect current consumer sentiment and competitive positioning.

Innovation Signal Detection: AI-powered analysis of emerging consumer trends, competitor movements, and cultural shifts that inform product development and brand positioning strategies.

Overcoming the Implementation Challenge: From Insight to Action

The most sophisticated consumer listening systems require more than technology implementation, they demand organizational transformation. Companies must move from quarterly insight reviews to continuous consumer intelligence integration across all decision-making processes.

Unilever’s approach provides a blueprint. Their comprehensive AI assurance process reviews proposed consumer intelligence applications, ensuring all insights are actionable and ethically obtained.

Cross-functional teams of subject matter experts assess potential consumer listening initiatives before deployment, ensuring insights translate into strategic advantage rather than data overload.

The most successful implementations focus on “assetizing” consumer insights by packaging AI-generated understanding into modular, reusable intelligence assets that teams can easily access and apply. This includes creating consumer insight APIs that product development, marketing, and supply chain teams can query in real-time.

The Momentum Imperative: From Consumer Confusion to Brand Relevance

The evidence is unequivocal: CPG companies that master AI-powered consumer listening will dramatically outperform those relying on traditional research methodologies.

The gap between consumer reality and brand understanding is widening daily, making superior listening capabilities not just competitive advantages but survival requirements.

As consumer behavior continues its rapid evolution, the companies that can listen smarter, faster, and more accurately will be the ones that reignite relevance with their consumers.

The 12% productivity advantage that AI-augmented teams achieve represents more than operational efficiency. It represents the speed advantage needed to stay connected with consumers who change their minds, preferences, and loyalties faster than ever before.

Through my work with CPG executives across 128 countries, I’ve observed that the companies achieving breakthrough consumer connection share one characteristic. They approach AI-powered listening with the same strategic rigor they apply to major brand launches or market expansions.

As someone who has worked with AI since its earliest commercial applications, I can attest that we’re now at the inflection point where consumer listening mastery will define brand relevance for the next decade.

The transformation from conventional market research to AI-powered consumer intelligence isn’t just about better data, it’s about rebuilding the essential connection between brands and consumers that drives sustainable growth.

The companies moving first and moving fast are already pulling ahead.

The question remaining is whether you’ll join them or watch your consumer relevance fade while your competitors listen smarter.

If you’re looking to Reignite Momentum in Your Career or Company, then we should talk!