Executive Summary

Most mid-sized CPG companies are investing in AI but struggling to scale real business value.

Studies show over 70% have launched pilots, yet fewer than 10% can point to measurable results.

The reason isn’t the technology, it’s a skills gap.

Teams lack the capability to frame the right business questions, interpret AI outputs, and act with confidence.

This article explores how mid-level leaders can turn stalled pilots into momentum by focusing on team capability, ownership, and fast, visible wins.

Real examples from US and European brands show how small, well-run projects can lift forecast accuracy, boost repeat purchase, and strengthen customer centricity. A clear 90-day roadmap helps innovation, insight, and marketing teams move from pilot to profit — and build the foundation for long-term growth.

If you prefer to listen to the podcast:

1) The uncomfortable truth about “we’re doing AI”

A recent analyst view on CPG quantifies the upside from AI at 8–16% of revenue for a $10B player, yet finds most companies still far from scale. Adoption ticks up across functions, but value remains locked without stronger operating models and skills. (McKinsey & Company)

A US snacks business I worked with looked busy for twelve months. Dozens of demos. Three proofs of concept. Zero commercial rollouts!

The turning point came when the BU head reclaimed ownership of one concrete decision that moved money every month, not a lab curiosity. The team stopped chasing tools and started answering one business question that mattered to the P&L.

What would change fastest in your world if one monthly decision became 20% sharper or 20% faster?

Suggested Action: Give a brand manager one financial question to improve this quarter. Tie the model to a meeting where that decision gets made. Measure before and after. Refuse side quests until a single use case pays for itself. Use that win as your internal case for the next build. (McKinsey & Company)

2) Skills, not servers, block the win

Analysts keep repeating the same finding. People and culture sit at the heart of success.

Talent strategy matters as much as models and data. Wider surveys across industries show companies struggle to achieve and scale value, not to start pilots. (McKinsey & Company)

A European dairy team had a solid data stack and a helpful IT partner. Results still lagged because brand and insights managers were unsure how to frame the questions, read the outputs, and change the plan with confidence.

A six-week upskilling sprint fixed more than a year of stalled pilots. Nothing exotic. Two hours a week. Real brand data. Side-by-side work with the analyst. Confidence rose, decisions improved, and the first rollout followed.

Where does your team feel least confident today: is it in framing the brief, judging model quality, or changing a live plan?

Suggested Action: Run a 30-day skills sprint inside the business, not a classroom. Use live decisions. Teach four things only: how to write a sharp question, how to judge output quality, how to act on it, and how to document the change. Rinse and repeat. (McKinsey & Company)

3) Pick use cases that prove value fast

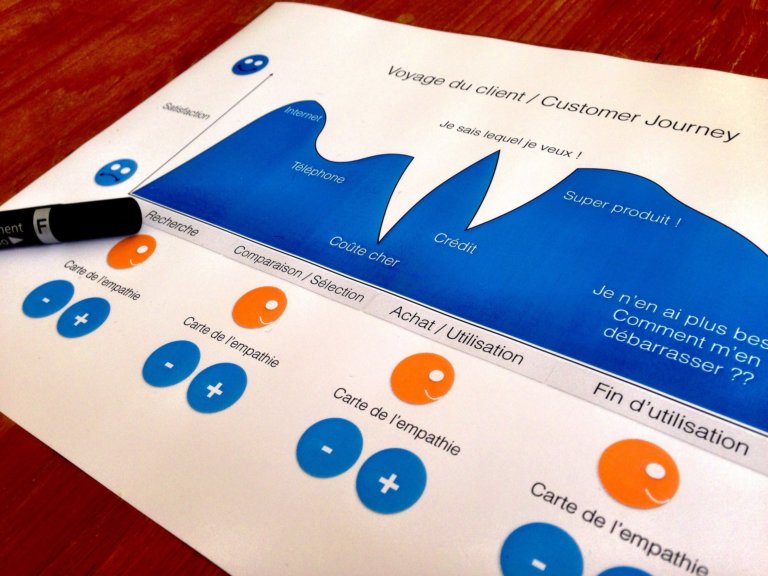

Analyst work across CPG highlights three early hunting grounds that pay back quickly: demand shaping and insights, customer and channel, and supply chain basics. The opportunity is big, but it concentrates where decisions repeat and data already exists. (McKinsey & Company)

A US beverages brand stopped boiling the ocean and chose one summer SKU set where stock-outs kept killing share. The team targeted a double-digit lift in forecast accuracy for those SKUs only. The model plugged into the weekly S&OP, not a side dashboard.

Availability improved in six weeks and the channel team saw it first at shelf.

Which decision repeats often, uses data you already hold, and shows up on one line of your P&L within 60 days?

Suggested Action: Shortlist three candidates. Score each on data readiness, owner clarity, and payback speed. Start with the one that has a business owner who can change the plan next month and a metric the CFO accepts. Skip clever, pick clear. (McKinsey &Company)

4) Don’t fight the retailer, partner on value

Category growth stalls when brands hunt for novelty while retailers care about reliability and margin.

Global reports across 2024–2025 show consumer businesses winning when they connect AI use cases to joint value with retail partners rather than running isolated brand tests. (Bain)

A cereal brand in the EU co-built a promo and assortment model with a major retailer. The algorithm was less interesting than the process. Joint hypotheses. Shared data. One combined dashboard used by both sides. End result was fewer promotions with better lift, plus a pack mix that moved faster through the local DC.

Which retailer would benefit immediately from one better decision you can now make together?

Suggested Action: Co-design one experiment. Share just enough data to answer one mutual question. Agree the one metric that matters for the retailer and the brand. Review together, then decide together. Use that success as your license to expand access and ambition. (McKinsey &Company)

5) Private label keeps you honest

Store brands kept pressure on price and value across 2024 and 2025.

Leading advisory houses advised CPGs to rebuild growth with clear price-pack roles, credible differentiation, and precise claims that win in seconds, not paragraphs. AI helps you find and test those claims faster, but only if the team knows what “good” looks like. (Bain)

A North American refrigerated brand mapped every pack to a job. One for trial, one for pantry, one for lunchbox. The team used model-assisted text and image testing to identify claims that boosted pick-up at the shelf. Fewer words. Bolder reasons to believe. The same work carried into retailer media and improved return where it mattered.

Which pack in your range deserves a branded premium and which should retire with dignity?

Suggested Action: Run a three-step value check. First, identify the job the pack really serves. Second, test two claim routes that speak to that job in under two seconds. Third, match the pack and claim to a retailer audience segment, then measure actual lift. Keep the winners. Cut the rest. (Bain)

6) Governance is the grown-up advantage

Surveys show most firms start many pilots but scale very few.

World Economic Forum research names a new trap after pilot purgatory. Call it the scaling slump. Early success appears, then systems, skills, and decision rights fail to keep up. (World Economic Forum Reports)

A Southeast Asian snacks brand escaped the slump by setting a simple rule. No new experiments without an “owner, outcome, and operating moment.”

Every use case had a named business owner. Each had a single metric tied to money. Each had a recurring forum where the output changed a plan. Ideas without these three failed the gate.

Who signs off the next phase, who funds it, and where in the calendar will the output get used?

Suggested Action: Create a one-page charter for each use case. Name the owner. Define the meeting where the output is used. Note the metric and the threshold for scale. Review monthly. Kill nicely and quickly when the bar is not met. (McKinsey & Company)

7) Case in point: big brands, real moves

Recent news shows snack and confectionery giants moving from talk to tools.

A global player behind Oreo and Milka invested >$40M in a generative system to cut creative costs by 30–50% and speed campaign production. Work rolled out in the US and Germany with plans to expand to Brazil and the UK. Results are reviewed by humans and governed by strict guidelines. (Reuters)

A luxury group operating dozens of houses scaled an internal AI platform used by tens of thousands of employees each month. The stack supports planning, pricing, design, and communication, and shows how enterprise platforms can spread when leaders invest in shared data and standard tools. Different category, same lesson for consumer goods. (The Wall Street Journal)

Which of your current marketing or commercial workflows could save money and time without harming quality?

Suggested Action: Pick one production task with a large repeatable footprint, set a savings target, and run a guarded rollout with human review. Bank the savings. Reinvest a slice into capability building for the teams who use it every day. (Reuters)

8) The first 90 days, mapped to your calendar

Cross-industry research confirms the pattern. Most companies can start. Few scale. The difference comes from a rewired operating model, not a shinier tool. (media-publications.bcg.com)

A practical path for a mid-sized CPG business unit:

- Weeks 1–2

Quantify one decision where money leaks. Select a use case with a visible owner and existing data. Write a sharp question. Example: “Can we lift forecast accuracy for our top eight summer SKUs by 12% and reduce stock-outs by 8%?” Use that sentence everywhere the project is discussed. (McKinsey & Company) - Weeks 3–6

Form one cross-functional pod. Four to six people. Business owner, insights lead, analyst, and an IT partner. Work in short cycles with a standing review meeting on the calendar. Build a minimal model and plug it into the meeting where the decision happens. (McKinsey & Company) - Weeks 7–12

Roll the output into the plan for one channel or one region. Track the one commercial metric you set at the start. Share results in plain language. Prepare a “copy and paste” guide to extend the use case to the next SKU, customer, or market. (McKinsey & Company) - Ongoing

Add a short, recurring upskilling slot to the team’s diary. Forty-five minutes every other week. Teach one real skill each time using current data and live decisions. Celebrate the win, not the model. (McKinsey & Company)

9) What to stop doing this quarter

Evidence says scale comes from operating model shifts. Not from piling on more pilots. Not from a bigger dashboard. Not from a vendor list that looks impressive in a board memo. (McKinsey & Company)

Here are three habits that slow you down.

- Chasing tools without a question.

Vendors will always be ahead on features. Your edge is the question only your team can ask and act on. - Treating data as IT’s problem.

Growth happens when brand, insights, sales, finance, and IT own one result together. - Reporting as if activity equals impact.

Nobody buys activity. Everyone buys lift in revenue, margin, or speed.

Replace those habits with one clear rule. If a build does not change a decision in a real meeting next month, it waits.

10) Your role as a mid-level leader

Latest industry outlooks keep coming back to the same point. Capability wins. Teams that combine human judgment with smart tools get ahead. Your job is to make that combination happen in one corner of the business where impact is obvious. (Bain)

A manager who sponsors one working pod becomes the person others call when they want results, not slides. Careers move when results move. Teams rally behind leaders who make complexity simple and measurable.

Which pod will you sponsor first and which decision will it change?

Suggested Action: Pick the owner. Book the meeting where the output will live. Set the number that proves progress. Ask for help where you need it, then start.

Where this connects to my tools

Some readers here will want a ready-made path, and I can suggest several to them:

- Use CATSIGHT™ when the stumbling block is the brief. You get a clean way to frame the business question, locate the human truth, and turn that into a testable decision. Find out more and learn to use it in under two hours HERE.

- Use QC2™ when the stumbling block is the operating model. You get a fast read of where the value leaks across company, consumer, brands, and processes, plus a plan to fix the bottlenecks that stop scale. You can find out more about the four essential elements of a customer-centric strategy HERE.

Want my team to run a half-day or 1-2 day working session with your BU, to set the first pod, the first metric, and the first rollout? Reply and I’ll send the outline.

Join the conversation

Which single decision in your area would benefit most from a 10–20% improvement in accuracy or speed? Post it below and I’ll suggest the fastest path to test it.