The first step of any business is to identify the category in which they are competing. This may surprise you, but you’d be amazed just how many brands are not in the category they think they are. When was the last time you checked how your customers saw you?

Just think about the consequences of an incorrect attribution; you would be concentrating on competitors that your customers never compare you with! And you would waste resources defending yourself against the wrong brands. Talk about squandering valuable resources! That’s why I decided to dedicate a whole post to this important topic.

But before I get started, I suggest you first read the post (Customer Centricity is Today’s Business Disruptor, Insights its Foundation) as background information. In it you’ll discover the full description of the seven steps of the CATSIGHT™ process, which I know will also be useful to you. In the article, I summarise the very first step of Insight development, that of category definition, like this:

C = Category

Whenever you want to develop an insight, the first task is to decide on the category you want to study. This may seem obvious to you, but in many cases, it isn’t as clear as you might have thought.

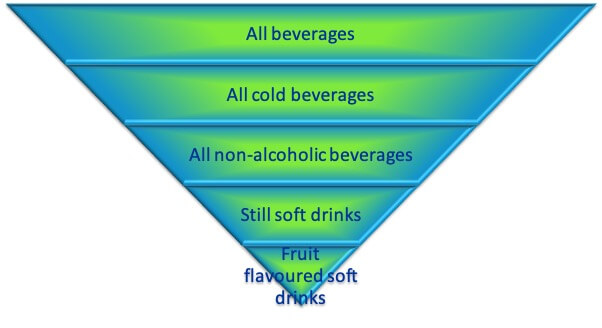

For instance, suppose you are planning on launching a new fruit-flavoured soft drink. You may think that you are competing with other juices or perhaps other soft drinks. But rather than just assuming the category in which you are competing, I highly recommend that you check; you may be very surprised.

In working with one client who was in this exact situation, we actually found that their main competitor was an energy drink!

Step 1. What is the category definition you are currently using?

In any process, we should always start by identifying where we are today. In the case of your category definition, it should be the one you think you are competing in at the moment. Depending upon whether you are offering a product or service, you might define it as:

All hot beverage consumers …….. or …….. users of a particular insurance service.

All consumers of coffee …….. or …….. people who have bought insurance for natural disasters.

All consumers of instant coffee powder …….. or …….. house owners in Florida who have bought insurance for natural disasters.

All consumers of instant coffee powder costing less than US$ 2.50 per 100 gms …….. or …….. owners of houses valued over US$2 million in Florida who have bought insurance for natural disasters.

As you can see from just these four examples, the bottom definitions are far more focused than the top ones. Hopefully you can appreciate why targeting such precise groups of customers is more likely to meet with greater success, than the wider, less specific groups first mentioned.

The Zoom tool you decide to use (in or out), will depend upon whether you are looking to grow your brand through your marketing activities or planning to develop a new product or service offer.

I call this zooming in and zooming out of the category. In general, understanding the category by zooming in is best for growth and precise targeting, whereas zooming out provides more opportunities for considering innovative new products and services.

Now take a look at your own current category definition. I bet it’s too broad for successful use isn’t it? This is the mistake that most businesses make, big and small. They want to attract the largest number of consumers or users of a category, but as is often quoted:

“If you try to please everyone, you end up pleasing no-one”

The more precise you are in defining the group of customers you are trying to attract, the more focused will be your actions and communications, and the more successful you will be. In addition, the tactics and strategies you use are more likely to resonate with your target audience.

Step 2. How is this category changing?

Once you have identified the precise category in which you are competing, you next consider what is currently happening to it. Is it stable, growing or declining? And why?

Understanding how the category is changing and more importantly why, will help you to understand it better and will allow you to evaluate its attractiveness more precisely. For instance:

– Is the category growing? If so, is it the leading brands which are increasing, or are there new brands that were recently launched, which explain the growth? Identifying which brands are growing and the reasons for this growth will enable you to take appropriate actions to benefit from it.

– Is the category stable? Are shares stable within the category, or are some brands gaining and others losing? Again, why? What do the brands which are gaining have in common? What are the losing brands lacking? Are the changes making a difference to the category definition? What can you do to protect your share?

– Is the category declining? Are all major brands in the category losing or are some gaining at the expense of others, but not maintaining overall category size? If so, again look at what the declining brands are lacking? Where are the customers who are leaving the category going to? Is there a new category which is better meeting their needs? If so, how? Should you be targeting this one instead? Or can you attract the customers of the brand that has left the category?

Your answers to these questions will help you to understand whether the category in which you are currently competing is going to remain as attractive as it is today.

Download C3Centricity’s brochure of popular training courses and speaking topics. Together we can help your team be more successful in their category definitions and target audience identification.

Step 3. How will this category change in the future?

In addition to current category trends, you also need to assess what is likely to happen in the marketplace in the coming years and how this may impact it.

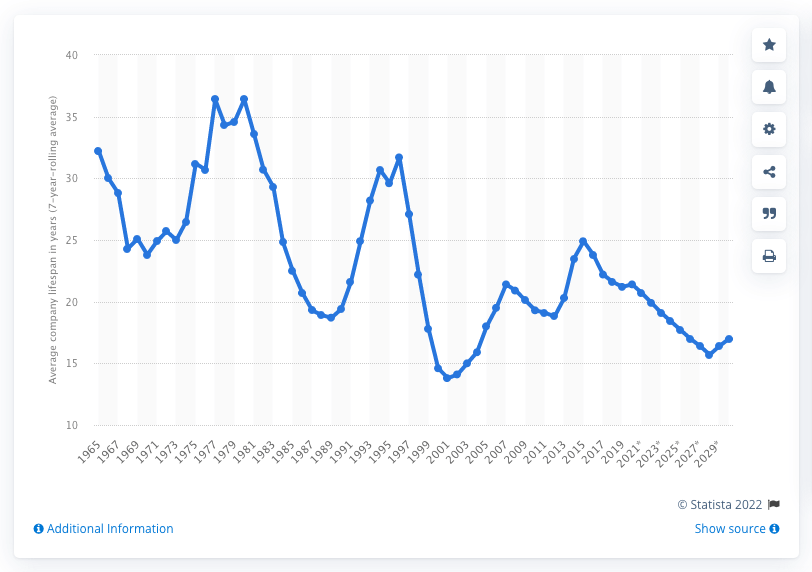

Things are changing faster than ever these days. There is no more “business as usual” especially since the covid pandemic and now the Ukrainian crisis. Expecting the unexpected has become the new norm, which is why I am such a big fan of scenario planning.

Industries are being disrupted and companies starting up and closing down at an ever-accelerating speed. According to an August 2021 article in Statista

“In 2020, the average lifespan of a company on Standard and Poor’s 500 Index was just over 21 years, compared with 32 years in 1965. There is a clear long-term trend of declining corporate longevity with regards to companies on the S&P 500 Index, with this expected to fall even further throughout the 2020s.”

Understanding who and what will impact your category is the first step to readying your organisation for the changes which could come. Preparing for likely future opportunities and risks is the second step, and the reason scenario planning is so vital to ongoing business success.

Step 4. Which of the category users are you attracting?

This question surprises some people. They expect that once they have identified the category in which they are competing, they can just start trying to attract everyone in it. However as the infamous quote from John Lydgate mentions:

“You can please some of the people all of the time, you can please all of the people some of the time, but you can’t please all of the people all of the time.”

You, therefore, need to single out those category users who would be most interested in what you have to offer. One of the many tools I use with my clients to help them identify the best segment for their brand, is the attractiveness and ability to win matrix, sometimes referred to as the BCG Matrix.

You can find out more about it in the article “How to Sell Less to More People: The Essentials of Segmentation.” This post provides a detailed explanation of how to divide all category users into relevant sub-groups, which you can then plug into the BCG Matrix.

Understanding which sub-group of all the category users you are most likely to appeal to with your offer, is one further step in focusing on the very best target audience for your brand.

Step 5. How are your customers changing?

- The introduction of a new category segment that is taking customers away from yours.

- Natural decline because of customers’ changes such as ageing, parenthood, or retirement.

- Behavioural changes that make the category less relevant than in the past.

Conclusion

Going through these five steps will give you the very best possible understanding of the category in which you are currently competing, as well as of the customers who make up the sub-segment you decide to target.

Have you successfully mastered every suggested step? What have you forgotten?

Is there something I myself have forgotten or that you would add? If so, then please share your ideas in the comments below. Thanks

If you’re still struggling with your own category definition or identifying the very best customers you should be targeting for your brand, then let’s talk. Book a complimentary call with me – I call them Happiness Sessions because that’s how you’ll feel after we talk!

This post is an update of the article that was last published on C3Centricity in 2020.